Writing a market research request for proposal (RFP) can seem like a daunting and overwhelming task.

The RFP process involves a lot of time, energy, and information gathering. This of course is all the work that comes before you've even started the massive task of reviewing the submissions and selecting a vendor.

Oftentimes it takes days if not weeks to review all the submissions as a team and find the best market research company that fits your needs.

But that's a little down the road for you.

Right now, you are either thinking about drafting a market research RFP, have recently started a market research RFP, or you are well into constructing it and you are looking for some tips to improve it.

Download Now: Free Market Research RFP Template

What You'll Learn in This Article

This post was designed to walk you through the market research RFP or RFQ process in greater detail.

Drive Research has broken down the core components of a market research RFP into sections.

Each section includes narratives on items you'll want to consider adding to your RFP and more importantly, why you should add it.

To skip to a section of most interest, click the navigation links below.

- Do you need market research?

- What are your objectives?

- Do you have a preferred methodology?

- If conducting customer research, what type of information do you have?

- Are there specific geographies or markets?

- What is your timeline?

- What type of reporting do you need?

- Do you have a budget?

- Determining who is responsible for rewards.

- Allowing bidding vendors to ask questions.

- What to look for when receiving your RFP back from a research firm.

It's critical to be as descriptive as possible with your requests and expectations in your RFP. This ensures the bids you receive can be comparable (apples to apples).

With that being said, there are some areas of the RFP where it may work to your benefit to be flexible and let the market research company decide on the best approach.

These more flexible sections are noted.

Before we start with specific components of the RFP, let's talk a little bit about market research in general. If you're at the beginning phases of the RFP process, the first question you might have is:

"Do I need market research?" 🤷♂️🤷♀️

If you are at the point where you are considering a market research RFP for your organization, you've likely already arrived at this answer.

There are many benefits of market research.

Regardless of the type of project, market research provides managers with the knowledge, power, and confidence they need in their decision-making.

At a very high level, market research produces fact-based and evidence-based decisions to help fuel strategy.

Market research comes in many shapes and sizes.

Whether you are looking to conduct a brand equity study, customer satisfaction study, or an employee survey, market research will help you eliminate the risk of making the wrong decision or taking the wrong path.

Data is power. When collected and used correctly, data can fuel operational, marketing, and strategic initiatives at your company or organization.

To learn more about your options, read Types of Market Research to Consider.

Still need convincing? Do you really, really need market research?

The answer is most likely yes. All organizations can benefit from it.

The ROI of market research is:

- Bettering customer relationships

- Better understanding of consumer behavior

- Understanding the appeal of a new product or service

- Quantifying potential success

And much, much more.

Market research is purely objective and uses hundreds and thousands of data points to point your business in the right direction rather than using the opinion of 1 person or a few board members.

This video goes into detail about how market research can help businesses save money - a common objective Drive Research hears from clients.

💡 The Key Takeaway: Market research provides a host of benefits to a business. The more data you have, the better you’ll understand your customers, employees, competitors, and more.

When structuring your market research RFP, you'll want to include your objectives.

The objectives section should be the first part of your RFP and it's arguably the most critical to the success of the research.

Be as clear and as specific as possible.

- Mention why you are requesting market research.

- Talk about what your expectations from the market research are.

- Discuss what you'd like as far as data and feedback to drive decision-making.

Most importantly, write about what you'd like to do with the market research results. The market research results are only as good as what is done with them.

Spend some time in your proposal for market research to discuss how you'd like the data to guide the next steps and action items.

Provide specifics on how you'd like the data and market research analysis to help guide initiatives at your company or organization. It is all about data-driven decision-making.

An RFP with clear and well-defined objectives will retrieve responses from market research firms that are more aligned and hit on all of your major goals.

Don't leave market research companies guessing your expectations.

It creates a lot of apples to oranges proposals because unclear objectives lead to different approaches.

It's important to tell the market research company and vendors what you are aiming for.

A few common objectives our market research firm has heard from our clients are:

- Level of customer satisfaction and individual factors driving high or low satisfaction.

- Performance of marketing or advertising campaigns.

- Customer experience with the company’s employees.

- Associations and perceptions of a brand.

- Sources of information and content used by target audiences.

💡 The Key Takeaway: Before you can write an RFP, you have to clearly state what your goals are. Having even a few clear objectives can simplify the process and avoid confusion down the road.

Download Now: Free Market Research RFP Template

Do You Want a Specific Methodology?

The choice is up to you on this. Some organizations will specify a specific methodology or methodologies they'd like the market research companies to bid on.

For example, you may be looking for one type of quantitative or qualitative approach – or a hybrid of the two, such as Wave I of focus groups followed by Wave II of an online survey.

If you leave the methodology open for discussion and bid, the market research firms are given the flexibility to think outside of the box and present you with new perspectives on how to tackle your objectives.

Qualitative research

When you think of the qualitative method, think small-scale and detailed.

This type of research is considered exploratory–it’s all about the “why” in research. Answers in qualitative research are often found through focus groups and in-depth interviews (IDIs).

Quantitative research

This type of research is the direct opposite of qualitative research. Instead of small-scale, think large-scale and big sample sizes.

Careful measurements are the name of the game with quantitative research, instead of exploratory research. It’s all about reliable data and gathering large groups of respondents in order to get that (pristine) data.

Hybrid research

Sometimes you can have the best of both worlds.

Hybrid research simply is a mixture of qualitative and quantitative methodology. When conducting hybrid research, the qualitative portion typically comes first.

This is ideal because having key details prior to quantitative research allows for better insight.

What method you choose to conduct first is, of course, dependent on what your research goals are for your project.

Allowing flexibility in the choice of methodology produces both pros and cons for your company or organization.

- Pro: This may include a new or revolutionary way of tackling objectives you had not thought of before.

- Con: The downside of this approach is it makes the comparison between firms much more difficult.

The advantages of stating your choice of methodology 👍

If you are open to the market research companies suggesting the best approach it could work in your favor because they may be able to present a more cost-effective, quicker, and higher quality approach.

For example, let's say you want to conduct market research to understand the usage of your current website and how to improve it for the major website redesign overhaul occurring next year.

Instead of asking for 6 focus groups in the RFP document, you leave the methodology up for choosing.

In this scenario, a market research firm could send in a response that suggests conducting 40 1-on-1 user experience (UX) interviews utilizing screen share technology.

This approach would save you $10,000, get you results 3 weeks faster, and the results would incur no group bias.

The UX interviews is a methodology you didn't even know was a possibility because your team had tunnel vision on traditional focus groups.

The disadvantages of stating your choice of methodology 👎

Allowing the market research firm to choose the best methodology for your project may result in your bids looking something like this:

- Firm A presents Wave I of 8 focus groups and Wave II of 800 online survey completes.

- Firm B presents Wave I of 25 in-depth interviews and a Wave II of 400 phone survey completes.

- Firm C presents one wave of 1,500 online survey completes.

Can you see how difficult it would be to compare these proposals?

As shown from the 3 scopes above, making an apples-to-apples comparison on price and timeline would prove difficult because the scope differs so much.

💡 The Key Takeaway: It’s important to weigh the pros and cons of being flexible in choosing your market research methodology. Consulting your third-party team and going back through your key objectives can help narrow down the choice.

Recommended Reading: Conducting Market Research? How to Choose the Best Methodology

For Customer Research, What Type of Information Do You Have?

If your company or organization has a strong CRM or customer database it will help save the market research company time and money to target, invite, and qualify participants for the study or studies.

In this part of the request for a quote, you'll want to talk about your CRM or customer database.

- What type(s) of data and information do you have on hand?

- What type(s) of data don't you have?

This makes a difference in the scope and bidding for the market research company.

The difference in price 💰

For example, the answer to these questions can make a difference between a 20-question survey and a 40-question survey.

In this case, doubling the number of questions will likely result in a much higher cost.

If your CRM tool has a significant amount of customer data such as age, ZIP code, and income, this will save the market research company from having to ask these questions in the survey.

As a result, they can structure the cost of the project to be more budget-friendly.

The difference in approach 📈

If your company or organization can tie telephone numbers or addresses to the participants, this will help the market research firm understand if email surveys, phone surveys, or mail surveys are an option.

It will also help the market research know if reminder phone calls to those who do not respond to the email survey is an option or not.

The difference in quotas ♂️ ♀️

From a segmentation perspective, it will help the market research company develop quotas and audiences for targeting.

Let's say your focus groups want to pinpoint those aged 25 to 34 with children in their households.

If you have this data on-hand it will make targeting and recruiting much easier for the market research company than if they had to call or email your entire customer list to screen.

- Examples like these create a more accurate proposal. ☑️

- Examples like these are why you should at least touch on the breadth and depth of your database. ☑️

If the market research company understands these nuisances it will help them more accurately and efficiently bid on your market research RFP.

This is why you should think about listing the fields of data you have available in-house.

💡 The Key Takeaway: Never underestimate the power of a customer database and reference that in your request for proposal process. Getting their information can alter the money you spend, the approach you take, and targeting practices.

Recommended Reading: Ultimate Guide to Conducting Customer Satisfaction Surveys

Do You Have Relevant Target Markets?

Understanding where you want to conduct market research is another key touchpoint for your RFQ.

A couple of questions you’ll want to answer in your request would be:

- If you are a national company with customers that span across the country, are there specific markets you want to research? Why?

- Do these markets match the demographics of your customers or are you looking for a market research consultant to choose locations for the market research?

This is largely true with qualitative market research such as focus groups or in-person in-depth interviews (IDIs).

These types of studies incur large travel expenses and can add considerable length to the project timeline.

Another example of this would be feasibility studies.

If you are looking to test the feasibility of a new product or service, perhaps the market research firm should suggest some of the top test market cities in the United States for you.

Why test markets are useful.

These test market suggestions could prove useful to your market research for a number of reasons.

Test markets are typically isolated, offer affordable media, and the demographics resemble national averages.

The location will play a major role in the scope and cost of the market research.

Clearly defining where you want the market research targeted or held will help you receive comparable bids. If you leave this variable open, it could present a wide range of options and costs.

💡 The Key Takeaway: Knowing the areas you want to target during your research is essential information in the RFP process. Understanding the key areas you need to target can help determine which research to use.

Download Now: Free Market Research RFP Template

Do You Have a Specific or Aggressive Timeframe?

Timing is everything. In your market research request for proposal, you'll want to clarify when you need the market research completed.

- Does the fieldwork have to be completed by a certain date?

- Do the analysis and the draft report need to be received by a certain date?

- Does the market research firm need to be on-site to present the findings on a specific date and time when your board is in town?

All of this information will be necessary to include in the RFP.

The timeline will dictate the scope and methodologies chosen⏰

Ideally, the more data the better. However, if the market research study needs to be fielded and concluded in two months, perhaps the intended 80 in-person IDIs will need to be limited to 40 IDIs.

Having a handle on these timelines assists the market research firm in planning.

If you are planning on the test product launching in 3-months, provide an expected date in the RFP so the market research firm can work its way backward.

Dates and deadlines for the market research are critical pieces for the RFP. Not only for the RFP submission and acceptance process but also for the study once fielded.

Dates add clarity and set expectations.

💡 The Key Takeaway: Having a project timeframe is crucial for success. This will help set the stage for additional deadlines and other important research factors.

Just how long does market research take? We answer that here.

What Type of Reporting Do You Need?

The type of analysis and reporting can have a major impact on cost. Without direction or structure, you may get several different levels of analysis in your RFP responses.

Some market research firms may produce a high-level summary document and that's it.

Other market research firms, like Drive Research, may provide you with options such as:

- An executive summary

- Recommendations

- Infographics

- Customer personas

- Hundreds of pages of banner runs

- A full Excel CSV file

One will charge you a few hundred dollars and the other will charge you thousands of dollars.

In the case of Drive Research, we offer various reporting packages to help fit into any budget. Most fall under either a topline or comprehensive market research report.

If you specify what you are looking for in the analysis and reporting it helps the market research company structure and plan for a report.

If you are looking for conjoint analysis, a Van Westendorp pricing model, TURF analysis, or regression, it will require some additional time and cost.

💡 The Key Takeaway: Spend time considering reporting resources for your RFP. Prices may vary greatly depending on your goals, and it’s important to understand the full range of what you need before heading into the project.

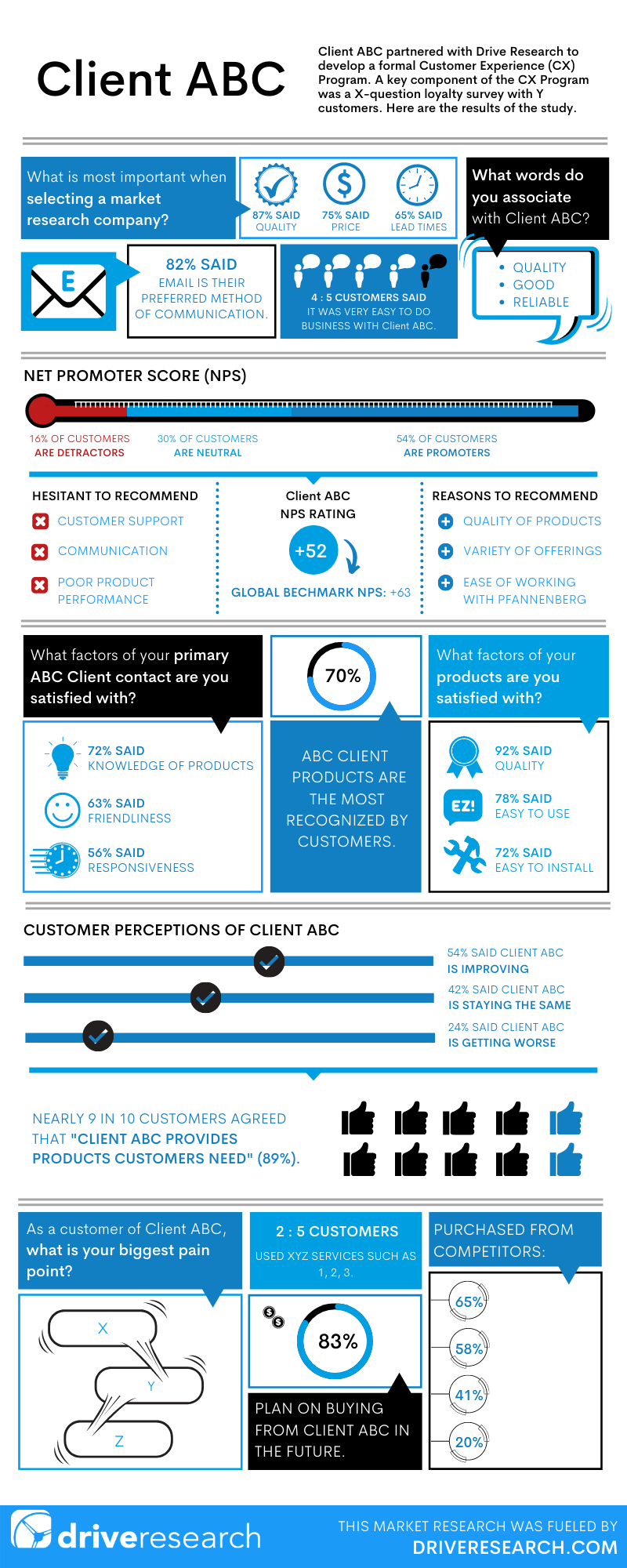

Sample Infographic in a Market Research Report by Drive Research

Do You Have a Budget or Budget Range?

This is an absolutely crucial piece of the request for proposal process.

The market research scope is often dictated by a budget. Market research companies want to present your company or organization with as much data as possible within your budget.

It's also understandably difficult for you to formulate because of the unknown. This is particularly true if you have never worked with a market research company before and are unsure of costs.

Defining some of the other categories we've listed in this article should help point you in the right direction of whether you are looking at an $8,000 project or $80,000 project.

The budget will dictate all recommendations and responses in a market research RFP.

It will guide methodology, timeline, geographies, analysis, and reporting. No one fact or figure in your RFP process will have more of an impact.

This is why it is critical to at least make an estimation or offer a range of your budget. Ask yourself or your team, what do you expect to spend?

As difficult as it sounds to list a budget or price range for your market research, it can prove crucial.

💡 The Key Takeaway: Budget cannot be emphasized enough when it comes to your market research request for proposal. Having a clear understanding of what your project will cost allows you to plan accordingly.

Recommended Reading: Should I Share My Project Budget with a Market Research Company?

Who Is Responsible for Rewards or Incentives for Participation?

One item in the RFP process that is often forgotten about but can have a large impact on cost is incentives or rewards.

Trust us, there are many reasons why you should offer a reward for your market research.

Do you have an idea of the rewards you want to pay for participation?

We suggest including some language on this because companies or organizations often have stipulations on what can or cannot be offered for participation.

Other companies have a stock and inventory of gifts and corporate items that can be given out as a thank you for participation.

If you have these types of rewards or an idea of what you'd like to offer participants, it will help to clarify this in the budget.

If you plan on fulfilling these in-house it could save the market research from overbidding on this in their RFP response by a few thousand dollars.

💡 The Key Takeaway: Don’t be afraid of offering rewards for participants–in fact, it can save you money. One reason being it may prevent overbidding if you offer rewards in-house.

Recommended Reading: Higher Rewards Can Lead to Lower Market Research Costs. Here's Why.

Will You Allow Bidding Vendors to Ask Questions?

Depending on your timeframe to accept bids, review bids, and make a decision, your company or organization will have to determine whether or not you are willing to have an open question and answer period.

Typically how the question and answer period works is you give vendors the opportunity to submit questions to you.

Here you will make it clear, no questions can be accepted after X date 🙅♂️

Then you give your company or organization a few days to review questions and write answers.

These answers are then posted to a public website for all vendors to review regardless of whether they have submitted a question or not.

Those who submitted questions are not singled out or labeled. The question and answer page is a section with generic questions with generic answers labeled 1 through 45 (or however many questions are received).

You'll likely receive several of the same or similar questions. In these situations, for the answer, you can write "refer to the answer on Q5".

💡 The Key Takeaway: Consider the factors that go into an open question and answer period with vendors. This involves setting a strict deadline, then taking time to answer questions.

What to Look For When Receiving RFPs Back From a Research Firm.

Now that you have a clearer picture of how to write a market research RFP, quote, or estimate, it is time to set expectations for what types of responses you will receive.

As a market research company, we know a thing or two about what to look for after you’ve requested the type of information included in this article.

Briefly consider these 4 factors before choosing your market research company.

1. Responsiveness 💨

We all know about those form fills or inquiries that go into the great abyss. In fact, we have sent many of these ourselves to unresponsive clients.

We have an immediate need, we reach out through a website form fill, and? Nothing. Silence.

Has this happened to you?

Likely.

When you send your RFP to a market research company, test the responsiveness.

An organization that gets back to you within a few hours, or within 24 hours is likely a company that has it together and one you probably want to consider working with.

If you are waiting 6 days for a response it is probably telling you a larger story. Just think about this...

That company will never offer better customer service or work harder for you than when they are trying to win your business.

Once they have it won, it's likely to go downhill.

2. Excitement and Interest 😃

There is a difference between a market research vendor who takes on new clients to simply execute a process versus one who is actually interested and passionate about the work they are likely to perform.

Our team loves what we do. There are market research companies out there that exist who simply enjoy the process. Things like writing surveys, programming surveys, analyzing data, etc.

Passion often translates to higher quality work.

Be on the lookout for this in your communications via email, telephone, and in-person. Are they interested in you? Or are they just interested in making a quick buck?

3. Background and Experience 🧠

While it is important the RFP focuses on your company’s needs and specifications, it is also helpful to inquire about the background and expertise of these firms.

If you are deciding between several different research companies, ask follow-up questions about their history, staff experience, and case studies for your vertical.

For example, if you work in retail, find a market research company that has direct or correlated experience in retail.

If you work in higher education, find a market research company that has worked in the educational space.

The benefit of finding a company with relevant experience is two-fold:

- First, they are more likely to understand the nuisances of your industry.

- Second, they are able to make anecdotal comparisons and pull insights from other similar projects.

All in all, it creates a more comprehensive outcome for your market research.

4. Cost Options 💵

As discussed earlier, it will be helpful to provide market research companies with your estimated budget – however, we know this is not always possible.

If you are unable or uncomfortable with sharing your budget for research, the consultant should be happy to offer varying levels or pricing options.

For example, 400 survey responses are optimal. It offers an industry-standard +/- 5% margin of error. At the same time, 400 responses are more expensive than 200.

If the budget is tight, the market research company should be willing to be flexible to offer options for 200, 300, and 400 responses.

💡 The Key Takeaway: The main elements to consider when receiving your RFP responses are the following: responsiveness, interest, experience, and cost. These are all essential elements that go into picking the right partner.

Final Thoughts

The end goal with any market research request for proposal is to ensure you have a clearly defined process to acquire high-quality and credible market research company bids.

The market research proposal process should also help you create a decision matrix that will assist you and your team in your choice.

For a summary, here are the core components and topics to address in your market research RFP.

This is the checklist you can take back to your company's or organization's team to guide you in writing your RFP in market research:

- Main Objectives

- Secondary Objectives

- Methodology

- Database or CRM Information Available

- Geographies or Markets to Target

- Timeline for the Market Research

- Levels of Analysis and Reporting Needed

- Budget or Budget Range

- Rewards and Incentives

- Question and Answer Deadline

- Question and Answer Responses Posted by Date

- Number of Vendors Chosen for Follow-up and Dates

- Final Decision with 1 Vendor Date

Download Now: Free Market Research RFP Template

Contact Drive Research for a Market Research RFP or Quote

Drive Research is a full-service market research company. Our clients span across the United States, as we work in a variety of industries and sectors.

Would you like Drive Research to bid on your RFP or RFQ? Contact us through any of the four ways below:

- Message us on our website

- Email us at [email protected]

- Call us at 888-725-DATA

- Text us at 315-303-2040

Emily Carroll

A SUNY Cortland graduate, Emily has taken her passion for social and content marketing to Drive Research as the Marketing Manager. She has earned certificates for both Google Analytics and Google AdWords.

Learn more about Emily, here.