One of my favorite industries for market research is the grocery store. I’ve always enjoyed marketing and impulse buying, which comes with the consumer packaged goods (CPG) industry.

The psychology of the shopper is never more exciting or complex than with consumers in the grocery store.

When it comes to market research for grocery stores, the options are endless, from both a qualitative and quantitative perspective. You are probably well aware of the standard online survey and in-person focus groups.

Online Surveys

Online surveys are the standard. With this approach, your organization works with a panel company or full-service grocery store market research company to work with end-to-end.

Working with a full-service firm helps you with a recommended approach, survey question design, programming, fieldwork, analysis, reporting, and action items from the data. However, if you can handle the majority of this in-house, it might make more sense to partner with an online panel company.

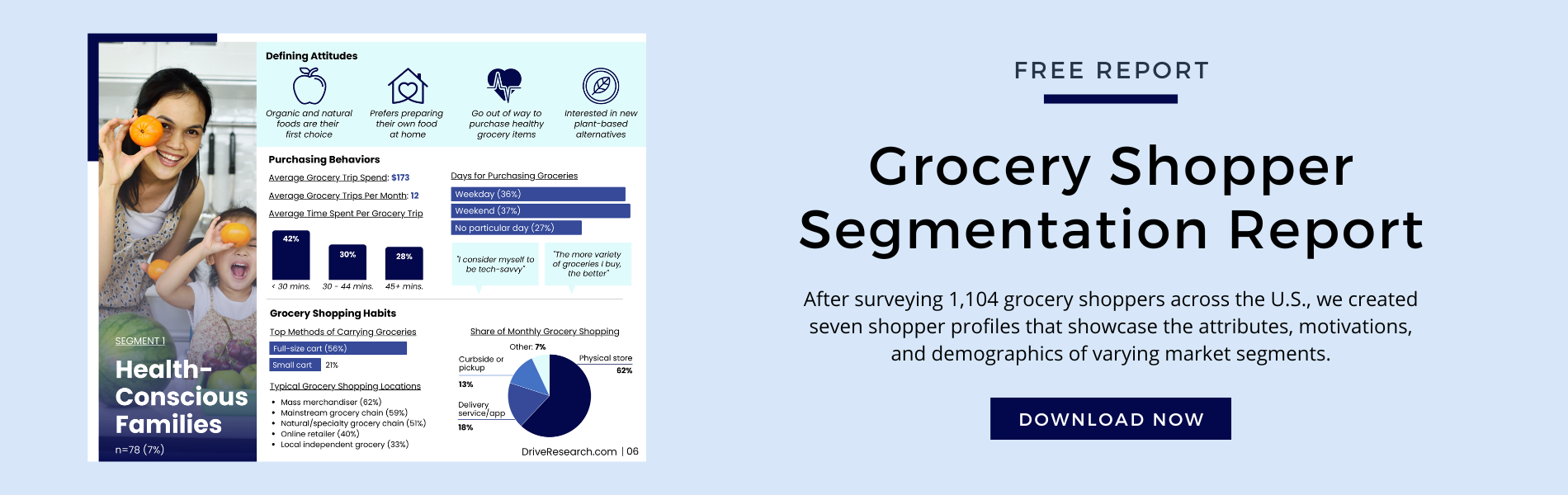

Download our Grocery Shopper Segmentation Report

Focus Groups

It is a similar story with focus groups. A focus group firm can help you with all of the steps. It would include a designed approach, markets to conduct the research, facility rentals, recruitment, moderation, reporting, transcripts, video and audio files, and recommendations.

Many firms like Drive Research offer all of those services, as well as pieces of the focus group process if you only need assistance with a facility rental or recruitment.

These are tried and true approaches to collecting feedback from consumers about grocery store purchases.

However, so many other innovative and unique methodologies are out there, which results in actionable insights.

Option 1: Mobile Ethnography

Mobile ethnography in grocery stores is the ultimate match made in heaven. One of the most considerable challenges with online surveys is the ability to recall what was going on in consumers’ minds when they made the purchase.

In a survey, if a respondent is asked: Why did you purchase Cereal Brand ABC?

The respondent might answer with price and taste. However, what if in-the-moment the respondent liked the packaging and color of the cereal brand over the two others, and that ultimately drove the choice? It is difficult to capture in an online follow-up survey.

Using a mobile ethnography tool and partnering with a CPG market research firm allows you to get into the minds of consumers while these purchases are happening.

A simple example of a mobile ethnography project might look like this:

- Recruiting 25 participants who are primary grocery store shoppers

- Have them record 5 to 10 video responses to survey questions before the visit

- While at the store have them record themselves in the cereal aisle browsing products

- The respondent is required to speak out loud and discuss their decision-making criteria

- Require them to diary specific parts of the cereal purchase (consideration, likes, dislikes, etc.)

A grocery store market research company like Drive Research can help you manage this fun and insightful project from start to finish. An executive summary of the findings from all of the videos is created to improve your marketing and strategy team to take immediate action.

Need more info? Here are four advantages of conducting a mobile ethnography study.

Option 2: Shop-alongs

The benefits of this approach are similar to mobile ethnography. The idea of a shop-along is to conduct the research and collect insights as close to the point of purchase as possible.

With a shop-along, a moderator walks the store with the grocery shopper. The facilitator asks a bunch of general grocery shopping questions in an attempt to hide the real objective of the research or the product (i.e., cereal in this example).

Why? If the moderator follows the shopper around the store quietly and asks no questions, that’s plain awkward and weird.

Secondly, if the only time the moderator asks the shopper a question is when he/she is in that specific aisle, it will bias the results in many ways.

Additionally, the shopper will not be warmed up to discuss and get into details right away, whereas if they had been talking more, they would have built a friendly rapport with the researcher already.

These shop-alongs are a great way to gather POP data. Whereas the mobile ethnography (respondent guided) research is more hands-off, the shop-along approach is more hands-on.

It offers more control for the researcher to keep the respondent on track and derive the insights needed. However, with the moderator shopping along with the respondent, it is not as natural as an experience.

Option 3: Intercept surveys

Another more traditional market research approach for CPG and grocery stores in intercept surveys. The process includes an interviewer who intercepts shoppers entering or leaving the store. Or, in many cases, inside of the store.

The interviewer carries a tablet with a programmed survey ready-to-roll that is often accessed through offline servers. It avoids any reliance on good satellite or WiFi connections in-store.

In the example of the cereal product, the intercept survey might stand at the end of the breakfast aisle and intercept shoppers before entering.

The survey might have a randomized list of products the shopper intends to purchase on this trip, one being cereal. If selected, the intercept interviewer continues with a survey on the tablet. It can either be administered verbally by the interviewer or self-administered by handing the shopper the tablet for the 10 to 15 question survey.

There are several different ways to approach this, including:

- Intercepting the shopper right after the purchase is made

- Intercepting the shopper as they enter the store

- Intercepting the shopper as they exit the store

In one study conducted by our CPG market research firm, we stationed the intercept team to talk to shoppers after they engaged with an endcap. In this situation, the interviewer would observe the shoppers, and if they stopped, engaged, or reviewing products on an endcap, we would then approach them and invite them to answer the survey.

Here are 7 intercept interview questions to help get you started!

Option 4: Geofencing surveys

Geo-fencing or location-based surveys at grocery stores is an entirely hands-off methodology. This method invites participants from a panel to respond to a survey. The shopper is pinged on their smartphone as they enter or exit a geo-fenced area. This area is drawn to match the grocery store.

Because the survey uses mobile IDs, the location-based aspect of the research is very accurate. These respondents have entered or exited the geofence based on their cell phone data.

Therefore, when a follow-up survey is sent, and a screener question is asked to determine if they shopped at the grocery store recently, the qualification rate is exceptionally high. With this methodology, no in-person resources are required. Feedback is returned through an online survey.

Learn why geofencing surveys are eliminating the need for in-person intercept surveys.

Option 5: AI or VR workshops

Perhaps the most exciting and exciting of all market research methodologies for a grocery store. With this grocery store methodology, the market research firm sets up a location which offers participant access to an AI or VR setting where they would browse grocery store shelves.

It is almost as if you are there without being there. Similar to shop-alongs, it allows you to ask questions to the shopper live as they browse the shelves and/or the store in a simulated environment.

Why a Third-Party Team Matters

Okay, so at this point, you know we’re fans of working with a third-party market research company (we are one, after all).

However, it’s important to note that you don’t need to work with a third party–but it’s often the best choice for businesses.

But there’s a reason behind why we promote it so much. Working with an outsourced team has a whole host of benefits that will ensure your project yields quality data.

Here are some of our favorites:

- Access to advanced research tools

- Years of industry experience

- Objective viewpoints

- Allows clients to focus on their own workplace duties

Again, we could go on and on as to why this is a good decision, but the reasons listed above should really seal the deal.

The advanced tools and knowledge of an outsourced team has been hard to match with an internal team. For instance, tools like what we mentioned earlier–online surveys and focus groups. These are both methods that need to be conducted correctly to gather useable feedback.

More often than not, market research teams have many years of combined experience in the field.

Would you rather save some money and have an internal team with little experience conduct your research, or would you rather spend some and get high-quality data to boost your brand? Yeah, that’s what we thought!

Yet another benefit of working with an outsourced team is that you get an outside view of your businesses.

Since you’re coming at this from an internal perspective, you may not be aware of certain industry trends, among other details. A third-party team has a keen awareness of this and lends objectivity to the project.

And because market research teams specialize in, well, market research–they take care of the hard stuff. This way, you can be involved in the project without devoting all your time to it. Your job needs to get done, too, and you can easily do that when working with an outside team.

💡 The Key Takeaway: There are ample benefits to working with a third-party team in market research for grocery stores, whether you work at a grocery store or elsewhere. The objective lens and experience they bring to the table make them invaluable in this process.

Contact Our Grocery Store Market Research Company

Are you a CPG brand, retail brand, or grocery store that is interested in working with a national market research company? Contact Drive Research by filling out the form below or emailing [email protected]. Our detailed proposal includes objectives, a recommended approach, timeline, deliverables, and fees.

George Kuhn

George is the Owner & President of Drive Research. He has consulted for hundreds of regional, national, and global organizations over the past 15 years. He is a CX certified VoC professional with a focus on innovation and new product management.

Learn more about George, here.