Competitors. Everyone has them – and whether you’d like to believe it or not, they are already stealing your prospects and customers. That’s why you want to be a step ahead of your competitors instead of wondering where your customers are going.

So how do you stay one step ahead? How do you win over buyers before your competitors do, or even better, pull their attention away from the competition? It starts with strategic, research-driven competitive analysis.

In this guide, our competitive analysis company will walk you through the basics of this type of research, the methodologies behind it, the components of a competitor assessment, why your business should conduct one, and more.

What is a Research-Driven Competitor Analysis?

Competitor analysis is a strategic process used to evaluate the strengths and weaknesses of your competition.

It typically looks at areas such as:

- Product and service offerings

- Pricing strategy

- Marketing tactics

- Customer experience

- Market positioning

The goal is to understand where your brand stands in the competitive landscape and uncover advantages you can use to move ahead.

You’ve heard the phrase…

“Keep your friends close and your enemies closer.”

In strategic business planning, nothing could be more relevant. A well-performed competitive analysis allows you to monitor rivals, anticipate their next moves, use weaknesses against them, and confidently differentiate your brand.

How does this differ from a SWOT analysis?

Unlike a basic SWOT analysis, these projects go deeper. The best competitive analyses combine qualitative and quantitative research to reveal insights that help you identify opportunities for improvement, highlight areas where you may be falling behind, and update strategies with real data.In the end, your organization receives clear, actionable intelligence on opportunities to pursue and threats to prepare for.

Types Of Competitors You Should Assess

Whether you’re a startup or an established company, every organization deals with competitors. To get the most out of a competitive analysis, you’ll want to identify who your main competitors are.

Not all competitors are created equal, and not all represent the same level of threat to your brand. That’s why it helps to segment them into categories, so you know which competitors you can learn the most from and where the greater risks are.

Direct Competitors vs. Indirect Competitors

At the broadest level, competitors fall into one of two camps:

- Direct competitors typically offer the same or very similar products or services to the same target audience. For example, Nike versus Adidas. Both target a similar customer base and compete head-to-head on price, features, branding, and distribution.

- Indirect competitors are harder to spot. They may sell different products or features but still solve the same customer problem. For instance, Nike might face indirect competition from a barefoot shoe company or even a subscription service for performance insoles. The overlap may be smaller, but these players can still steal market share.

Knowing both types ensures your analysis doesn’t miss threats that feel “outside” your industry but still compete for your customers’ attention and dollars.

Once you’ve identified whether competitors are direct or indirect, the next step is to understand what role they play in the broader market. Not all direct competitors fight with the same strength, and not all indirect competitors carry the same influence.

At Drive Research we often group competitors into four main categories: market leaders, challengers, followers, and nichers which we’ll outline below with the example of athletic shoe brands.

1. Market leaders

Market leaders are the dominant players in the industry, often holding the largest share. They usually lead in brand recognition, innovation, marketing spend, pricing power, and distribution. Leaders set the tone, influence trends, and shape customer expectations.

An example of a market leader for our “athletic shoe brand” would be Nike.

2. Market challengers

Market challengers are strong competitors working to capture market share from leaders. They may not be number one, but they actively push to overtake the top brands through innovation, aggressive pricing, or visibility.

An example of a market challenger for our “athletic shoe brand” would be Adidas.

3. Market followers

Market followers hold a stable position but don’t drive innovation. They tend to imitate successful strategies rather than test new concepts. These brands often compete on price or by offering simplified versions of premium products.

An example of a market follower for our “athletic shoe brand” would be Sketchers.

4. Market niches

Market nichers carve out specialized segments by focusing on a well-defined audience. Instead of competing broadly, they tailor products, messaging, and distribution to meet the needs of their niche. Many start small but scale after winning loyalty from their core customers.

An example of a market nicher for our “athletic shoe brand” would be Fabletics.

Benefits Of Doing a Competitive Analysis Project

The well-executed competitive analysis research project can help your business overcome some of the obstacles holding your brand back (like high customer churn) and gives you an opportunity to see what other brands are doing.

By seeing what’s working for other brands, you can often take those insights and use them as a roadmap to make better business decisions for your own brand

Keep reading for some of the highest impact benefits we’ve helped our clients get from completing a competitive analysis project.

Or for a quick recap, watch as our team discusses the benefits of conducting competitive market research.

1. Keep Benchmarks on Your Competitors

Many of our clients use competitive analysis on an ongoing basis, rather than as a one-time study. This regular feedback creates a powerful advantage, allowing brands to benchmark competitors not just against today’s performance or strategy, but against how those strategies have evolved over time.

With consistent benchmarking, businesses can move from being reactive to proactive. If a competitor drops their prices or consistently launches new products, you’ll see it in real time and have the chance to adjust your own strategy quickly, giving you an edge.

Frequent data collection also keeps you tuned in to many parts of your competitors’ business—products, pricing, services, and marketing offers. By tracking shifts in these areas, you gain insight into how trends are changing and by how much.

The alternative is waiting months or even a full year to learn about these changes, leaving you behind. A steady flow of competitor data gives you the confidence to make sharper, faster, and more successful business decisions.

2. Understand What Makes You Different

Yes, we’re going there—your unique selling proposition (USP) 🙄. It might sound like old-school jargon, but in competitive analysis research, it’s front and center.

Ask yourself and/or your team questions like:

- What products or services do we offer that competitors don’t?

- Why do customers choose us over competitors?

- Are we faster, more competitively priced, better rated, or more specialized than competitors?

These kinds of questions don’t always have instant answers.

But here’s the thing: your competitive edge often lives in those answers, if you can define them clearly.

If you’re struggling to pin them down, a competitor analysis can bring clarity quickly. It’s designed to help you uncover what might otherwise stay fuzzy or overlooked.

Another important piece of competitive research is digging into your competitors’ product or service offerings. The more detail you gather about what they provide, the easier it becomes to spot overlaps, gaps, and opportunities for improvement in your own strategy.

To simplify, here are five things you should examine when conducting a brand competitive audit.

3. Improve Your Sales Positioning & Brand Messaging

A research-driven competitive analysis doesn’t just uncover what products or services your competitors offer. It also reveals how they position themselves and the messaging they lean on to stand out.

Maybe one competitor highlights low prices. Another might focus on speed. Others could emphasize advanced tech (AI gets a lot of play these days), luxury quality, or highly personalized options.

Each competitor usually has a unique mix of talking points and knowing what they emphasize can show you where your own message stacks up.

So what does this look like in practice? Here’s a simple side-by-side view of competitor messaging and how you can position your brand to stand out.

| Competitor Messaging | Your Brand Opportunity |

|---|---|

| 💲 “Lowest prices guaranteed” | Highlight added value beyond cost (e.g., better service, long-term ROI) |

| ⚡ “Fastest delivery in the market” | Emphasize reliability and consistency alongside speed |

| 🤖 “Cutting-edge AI technology” | Showcase your balance of tech + human expertise |

| 💎 “Premium quality, luxury feel” | Reinforce quality standards with proof points (reviews, case studies) |

| 🎯 “Custom solutions for every client” | Call out personalization in your marketing if you offer it but don’t highlight it yet |

These are the insights a competitive analysis uncovers. It helps you identify the small but powerful adjustments to your sales and marketing message that could make all the difference.

4. Leverage Competitor Weakness & Customer Complaints

One of the smartest ways to get ahead of competitors is by uncovering where they’re falling short. Luckily, a lot of that information is already out there through online reviews and ratings where customers leave unfiltered feedback.

But that’s just the start.

With the help of a market research company, you can go deeper through online surveys designed to capture exactly how a competitor’s customers feel about them.

Once you know what’s missing, you can position your brand as the stronger alternative.

Say customers are constantly frustrated with a competitor’s shipping times…

If your brand delivers in under 48 hours, that’s not just an operational win, it’s a messaging opportunity. Highlighting that difference in your marketing and branding makes it clear where you outperform.

Every weakness in your competitors’ customer experience is a chance for your brand to shine. A well-executed competitive assessment (especially one backed by surveys and exclusive data) uncovers those gaps and gives you the confidence to use them to your advantage.

Components of a Competitive Analysis

The goal of a competitive analysis is to get a 360-degree view of your brand’s position in the market in comparison to your competitors strengths and where areas of improvement are.

Like other forms of market research, competitive analysis projects are highly customizable. The methodology, scope, and depth are flexible depending on your goals and wants. Some brands don’t need more specific parts like pricing or reviews while others might require it.

\A skilled market research firm will tailor the project to your goals and what your brand can benefit from the most.

We’ll discuss the most common components of a competitive assessment project. They can be all included in one project or not but they are at least different sections you can elect to include or not.

1. Website & Digital Presence Audit

In today’s digital world, your brand’s website is often the first impression your brand makes and in a competitive market, that impression should be findable and functional.

While many organizations focus on the visual design of the site, these efforts don’t mean much without any visibility.

A strong SEO strategy is crucial to ensure your site can appear for terms your audience is searching for. It’s especially important for your core services or products for your audience to be able to find them easily.

In fact, websites on the first page of Google captures over 90% of organic search traffic.

For this reason, as part of our competitive analysis, our team always includes a detailed website and SEO audit so you know how your site is performing compared to your competitors and how you can improve it.

We look at core factors like:

- Page Titles & Meta Descriptions

- H1 & H2 tags

- URL Structure & Site Organization

- 404 Errors and Site Health

- Domain Authority

- Technical SEO like page speed and broken links

Alongside SEO we also assess user experience on your site (along with competitors) and how the navigation makes sense, content quality, content clarity, and overall usability. This looks at whether your site meets expectations of your audience compared to your competitors’ sites and the gaps in which you can improve your site or even outperform your competitors.

User experience can also be its own standalone project because of its depth. Our team can conduct moderated website testing, where users share their screen while exploring the site just like how a real user would act on the site, and provide detailed feedback about the experience.

2. Product/Service Comparison

As part of the competitive analysis, our team conducts a thorough audit of competitors products/service offerings to help you understand how yours measures up to the rest of the market.

The goal is to understand where your brand is in terms of market coverage and the value proposition your positioning showcases.

Our team is looking for two main things when diving into this part of the analysis:

- Gaps: products or services that your competitors offer that you don’t

- Differentiation: offerings that are unique to your organization that help set you apart.

We organize these findings into a visual matrix that allows you to quickly find competitive advantages or disadvantages. We’re especially looking for opportunities for brands to be able to innovate, meet customer needs, and other product opportunities.

We’ve helped clients in various industries like ecommerce, healthcare, financial services, and more track their market performance over time with our competitive analysis projects.

3. Pricing Strategy Review

Pricing has a big influence on how people see your brand. Whether you’re aiming to be the affordable option, the premium choice, or somewhere in between, your messaging needs to line up with that strategy.

As part of a competitive analysis, we recommend digging into pricing for both your brand and your competitors to understand where you stand today—and how those positions shift over time.

For instance, we track this data across different time periods (3, 6, or 12 months), giving you a clear view of how often competitors change their prices and whether you’re staying ahead, falling behind, or right in line.

To make it easy, we pull everything into a visual pricing matrix. At a glance, you’ll see whether you’re overpricing, underpricing, or positioned exactly where you want to be.

Our team has used this approach to help clients in ecommerce, healthcare, financial services, and more keep tabs on pricing strategy and make smarter moves over time.

4. Marketing Strategy + Brand Messaging

The marketing audit reviews all of the marketing messaging and outreach being used by your competitors.

This might include items such as:

- Sales collateral

- Social media advertisements

- Whitepapers

- Emails

- Blogs

- Webinars

Our competitive analysis market research company logs all of the marketing activities into a matrix and attaches all marketing files to the project folder for your review.

After reviewing all of the different types of marketing, Drive Research outlines the key messages and brand values the competitors consistently use in the outreach to generate sales.

The marketing audit also reviews social media platforms your competitors use and logs which have a presence on including type(s) of content shared and frequency.

This could include an inventory of platforms such as Facebook, LinkedIn, Twitter, Instagram, and others. The social media portion of the competitive analysis will also review any ads being run on platforms.

For more details, read our blog How to Run A Competitive Analysis in Marketing

5. Competitor Sentiment & Reviews

Traditional audits focus on what your competitors are saying about themselves, but in our audits we make sure to look at what customers are saying about them (and how they feel about them). This aims to look at below surface level items about customer feedback, language, tone, and emotional triggers.

There are the main ways to find competitor reviews:

- Online reviews

- Social media comments

- Public forums or Reddit discussions

- Live testimonials and case studies

- Survey data (if applicable)

By analyzing the data across all these channels, we look for patterns in language about competitors that show positive, neutral, or negative sentiments. We especially note them if the reviews are tied to specific products, services, or customer experiences.

These insights are helpful in shaping your brand’s positioning, marketing language, and overall messaging. It’s because the data you’re learning from is your competitor’s customers’ direct feelings.

Competitive Analysis Methodologies To Use

Just like there are different parts to competitive analysis, there are multiple ways to collect and compile your data. Typically at Drive research, we use as many components as you want and include them all in the same study but we include all types elected for. We’ll also be sure to include both primary and secondary data as needed but different methodologies will rely on different research types to get their data.

For example, if company A only wants to compare websites, that’s secondary data that we will pull ourselves using a method that is essentially desk research and would suffice for the project to get all the necessary data.

If company B wants to do pricing research, that’s typically a deeper look into the data and we at Drive Research like to use multiple methodologies to complete this by combining both qualitative and quantitative data that is usually primary research we are gathering for your brand. For pricing research we may use a combination of custom surveys and desk research to get all the data needed.

Here are the most common methodologies that are used in competitive analysis projects (we use all of these at Drive Research) and how they might be applied in the competitive analysis project.

Desk research

This is a simple one, but searching Google for information is a tried and true basic research method. In fact, our team sometimes calls ourselves professional Googlers.

A more specific example of how Google is used in market research is compiling information about competitors.

For example, if a hotel is conducting a competitive assessment it would be valuable to understand:

- The number of hotels within their market

- The number of rooms at each hotel

- Amenities provided at each hotel

- Location

- Nearby restaurants

- Nearby entertainment

This example just scratches the surface of the types of information available via desk research.

Similar to Google, Census data is used by market researchers to learn more about the market, which is a key piece to a competitive assessment.

The benefit of using Census data is the ability to understand where the market has been, where it currently is, and projections.

There are a ton of different types of information you can learn from Census data, but primarily demographic information. This includes:

- Population sizes

- Breakdowns of genders

- Breakdowns of ages

- Breakdowns of ethnicities

- Income levels

- Housing

At Drive Research, our team uses a proprietary in-house data system to provide this type of market data for our clients.

Our subscription to Alteryx data gives us access to millions of data points on consumers across the U.S., more than what the Census.gov site offers a general user.

This type of secondary research can be customized based on the needs of the competitive assessment.

Online surveys

Wondering how your brand perception, awareness, and satisfaction stack up against competitors from the minds of consumers? Why not ask? Online surveys are a great, easy, and cost-effective way to learn more about your competitors.

Online surveys are a customizable research tool used for measuring, meaning that if you want to place a numeric value on how well your brand is perceived compared to several competitors an online survey will answer that.

An added bonus to this data collection approach is that surveys can be completed quickly. At Drive Research, our team can complete a competitive assessment online survey project in as little as 1-2 weeks!

We typically recommend two main core types of surveys in competitive assessments:

- Brand awareness surveys: The main purpose of a brand awareness study is to measure levels of awareness of the sponsoring brand as well as its key competitors. It may also address the usage and perception of the brands tested.

- Brand equity surveys: A brand equity study is similar to a brand awareness study as it measures levels of awareness, usage, and perception. But, it will also cover other key performance indicators like decision-making factors when choosing a brand, levels of satisfaction with the brand used, likelihood to recommend the brand use, and likelihood to switch to the brand sponsoring the survey.

In-depth interviews (IDIs)

In-depth interviews (IDIs) are a qualitative market research method used to gather feedback from key stakeholders.

An IDI discussion guide is customized based on the research objectives. The guide is precise in question language, order, etc. During the conversation, market researchers will ask strategic follow-up questions to ensure the right information is gathered.

Once the IDI is complete, the researchers write a summary based on the conversation keeping the interviewee anonymous. After all the interviews have been completed, a report will be created based on the findings.

Why would you want to use in-depth interviews for competitive assessments?

The beauty of IDIs is that the conversation can reach deeper, more specific levels than what can be learned through an online survey, Google search, and Census data.

Online surveys are powerful, but if the research goal is to understand in-depth feedback from a few specific contacts, an IDI might be the right choice or addition for your market research project.

- If your competitive assessment project includes an online survey, select respondents can be chosen based on their responses to participate in a follow-up IDI.

- If your competitive assessment project does not include an online survey, the market research company can recruit participants based on your targeting criteria.

Read this blog post to learn more about the step by step process for conducting in-depth interviews.

Steps to Conducting Your Perfect Competitive Analysis

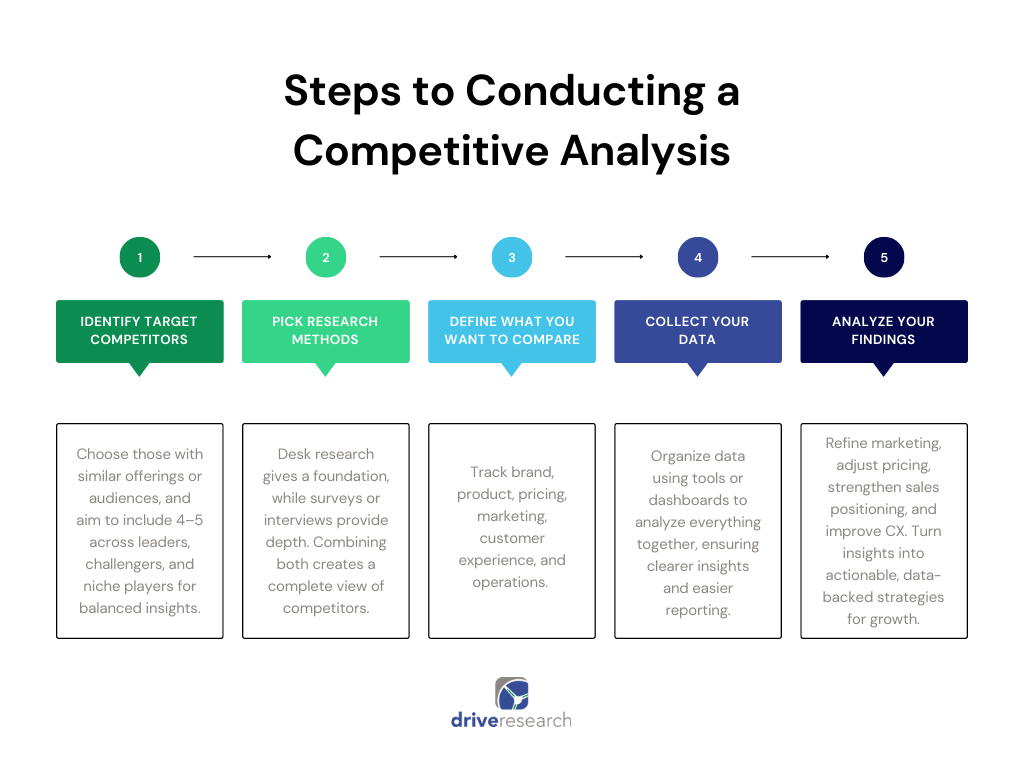

Now that you know the components and methodologies that go into a competitive analysis, we’ll show you how we do competitive analysis projects and how you could do it yourself with these steps.

This includes whether you’re doing just a basic competitive website audit or a full-scale deep dive into every single competitive aspect.

1. Identify your target competitors

The first step in making your competitive analysis successful (and worth the time or money spent) is deciding which competitors to analyze. Not all competitors are equal, and depending on your goals, you may only need to focus on specific ones.

Start by considering both direct and indirect competition. Look at who offers similar services, targets the same audience, or shares overlapping pain points and messaging. These are often the most worthwhile to include.

It’s also important to know where each competitor stands in the market: leaders, challengers, followers, or niche players.

Depending on your objectives, you may only need to focus on a few from each category. At Drive Research, we typically recommend selecting at least one from each, as long as they are relevant to your business.

Clients usually come to us with a shortlist, and we help expand it by adding valuable competitors they may not have considered. As for how many to include, most analyses look at 4–5 competitors, though it’s common to see fewer or more. In general, more data is better, so we suggest a minimum of four.

2. Pick your research methods

Once you’ve selected your competitors, the next step is choosing the right research methods. If you’re working with Drive Research or another third party, we’ll guide you on which methods make the most sense. Otherwise, it’s important to know which approaches work best for your specific type of research.

Desk research is often the starting point. It consolidates publicly available information and provides a solid foundation of basic knowledge about your competitors.

From there, you can layer on additional methods depending on your goals. For example, if you need pricing or product insights, primary research methods like online surveys or in-depth interviews will give you more reliable data.

The strongest competitive audits combine both primary and secondary research. This blend ensures you capture a complete view of the market while tailoring the methodology to match the outcomes you want to achieve.

3. Define the metrics you want to measure

You’ve picked your competitors and methods, now it’s time to decide what you want to measure. Some will be obvious, like pricing or online reputation, but go deeper.

Ask yourself what specific questions you want answered for each area—such as which platforms to evaluate for reputation or which details matter most in pricing research.

You’ll likely know the main metrics already, and if you’re working with a competitive analysis expert, they can guide you on what else to include. Otherwise, create a full list of the metrics you want to capture by the end of the project.

Common metrics include:

- Brand: awareness, perception, loyalty, NPS, equity, trust

- Product/Service: features, satisfaction, usage rates, quality perception

- Pricing: price points, discounts, value perception, frequency

- Marketing: social engagement, ad spend, SEO visibility, content volume

- Customer Experience: reviews, complaints, praises, loyalty messaging, churn risk

- Operations: service area, delivery times, support quality, tech stack

The best approach is to combine quantitative metrics (like survey data) with qualitative insights (like interviews). This ensures you capture the complete picture of your competitors.

4. Collect and organize your data

Once you’ve got the preliminary stages completed, you’re ready to start collecting data. In this section you’ll also want to define the audience you want to target for the data (if you’re using primary research) and also how you’re going to target them (if you haven’t done this already).

Most importantly, you’ll want to track all of your data by organizing it. We use a proprietary method at Drive Research that allows us to compile all data into one place almost like a data matrix and that way we can analyze it easier at the end of data collection.

You can combine organization methods like survey dashboards, desk research log, and folders but at the end you’ll still want to be able to analyze all of your data together. We do this for all of our clients and it makes finding insights and especially showing those insights much easier.

5. Analyze your findings

You’ve collected all your data and now it’s time to analyze. This is where the real value of a competitive assessment comes in—turning information into actionable insights.

As you review the data, look for gaps, trends, and opportunities.

Ask yourself: Are competitors outperforming in certain areas? Do they offer something you don’t? Is their messaging different from yours? Are there opportunities you haven’t pursued?

These surface-level questions can be customized for each section of your analysis. For example…

- In marketing, refine messaging or offers to close gaps

- With pricing, adjust strategies to meet unmet needs

- In sales, equip your team with stronger talking points and positioning tools.

- For customer experience, address recurring pain points to strengthen loyalty.

If you’re working with Drive Research or another third party, this process is streamlined for you. You’ll receive a comprehensive report summarizing all insights, giving you data-backed guidance to fuel strategic decisions.

How Often Should You Be Doing Competitive Research

It’s important to remember that these competitor analyses are done at a snapshot in time. Especially if you’re just doing a one-off project, you’ll need to keep in mind the time at which you took the data since strategies evolve and competitors change. It may be unwise to rely on old data for new decisions.

To keep an edge on competitors, you’ll want to do regular competitive analysis projects as possible. The frequency will depend on your industry and goals but a common frequency is yearly, semi-annually, quarterly, or monthly.

In certain industries like tech or financial services you may need as frequent as monthly or quarterly to understand the change in product offerings, pricing strategy, and more since these industries are constantly changing.

The main idea is you want to be confident in your decision making which means you want to be confident in the data you’re relying on. The more outdated your data is, the less confidence you might have in it which is why doing regular competitive assessments can help you stay ahead of the game.

Do You Need to Hire a Competitive Analysis Company?

The short answer is yes and we’d love to help. If you’re ready to get started, contact us here to a custom quote. If you’re still on the fence then let’s go back and show exactly why you want or need to hire a good research partner for competitive analysis.

Or watch this short video before choosing to conduct market research in-house.

Save time and internal resources

Most often companies looking to conduct competitor research reach out to a third party because they simply do not have the time or resources to do so.

No one will argue competitive research isn’t extremely valuable. But what often happens is it gets pushed to the back-burner at an organization because it is extremely time-consuming.

Researching, logging, and inventorying all of this information can take a lot of time.

It involves many hours of visiting competitor websites and including the information into a template that can be easily understood and repurposed with the sales team and management.

A market research team typically has a systematic process to make the data collection period more efficient.

So, while you are tackling your other priorities at your organization, let a competitive analysis market research firm work in tandem with you to collect this information.

Trusted third party

This specific benefit of hiring a competitor market research company is crucial if you plan to share the data in your marketing efforts.

Will potential customers trust data points that claim your brand is better than a competitor if the research was conducted in-house?

Consumers are smart. They can easily detect stealth marketing or false advertising. One easy way to avoid this is by partnering with an independent third-party research company you can source in all marketing materials.

Confidentiality

As the sponsor of a competitive analysis project, it is crucial the study be blinded. A blinded study is one that does not disclose the sponsor of the market research to the respondent.

In short, this means you will be conducting this competitor research anonymously by partnering with a third party.

If utilizing an online survey in your competitor analysis, the main benefit of a blinded study is that it takes response bias out of the equation.

However, using an online survey component or not, conducting the research anonymously assures competitors do not find out you are mystery shopping them.

What Does a Competitive Analysis Market Research Project Cost?

A common misconception about market research is that it is extremely expensive and likely only affordable for million-dollar companies.

The truth of the matter is, that the scope of a competitive assessment can vary greatly. There are many factors that can drive the cost of a market research project up or down.

It can be helpful to provide some insight into your project when requesting a quote from a third party.

The only way to get a finite estimate for your specific competitor analysis is by contacting our team. By sharing your objectives and specifications for this project, we can create a customized proposal for you to review.

Luckily our team works fast. On average, we can send our proposals back to prospective clients within 24 to 48 hours.

Here are a few questions a competitor market research company is sure to ask you before they provide a cost estimate.

What research methods are you considering?

As we discussed earlier in the guide, a competitive assessment generally consists of four components:

- Website Competitor Audit

- Competitor Product or Service Analysis

- Competitive Pricing Analysis

- Marketing Competitor Audit

The price of competitor analysis increases with every component that is included.

What type of data collection methods do you want to use?

Again, there are many different approaches to collecting data for a competitor assessment. An online survey will be cheaper than an in-person mystery shopping program.

Not many organizations know exactly how they’d like to collect competitor data when consulting a third party – and that’s okay too!

Drive Research can work with you to provide a variety of pricing options and recommend which approach is best based on your objectives and budget.

How many competitors do you want to analyze?

The competitive landscape changes for every industry and business size. There are some markets that are more saturated than others and naturally have more competition.

The more competitors you’d like to include in an audit, the higher your project scope will be. There is a big difference between auditing 25 different brands than auditing 5.

Sharing a rough estimate of how many businesses you’d like to include in your competitor analysis can help the market research company provide a more accurate proposal cost and methodology recommendation.

Contact Our Competitive Analysis Company

If you’re looking to better understand your competitors and uncover opportunities in your market, our competitive analysis company can help.

Drive Research specializes in gathering reliable data and turning it into clear insights that guide smarter strategies. Whether you need to benchmark performance, evaluate positioning, or identify market gaps, our team delivers research you can act on. Contact us today to learn how a tailored competitive analysis can give your organization an edge.