Thinking about conducting market research with doctors or physicians? There may not be a more challenging audience to reach and receive feedback from.

Doctors are very busy and focus their time on assisting and guiding patients. Trying to squeeze in a survey or short conversation for research purposes can prove very difficult for these medical professionals.

However, our healthcare market research company is here to help. The tips below will help guide your team to ensure your project is set up for success and you approach it the right way.

The tips offer advice around the scope of your market research, the methodology to choose, the rewards, and the scheduling. Use these tips to guide your team or organization on your next market research study.

What is Market Research?

Before launching a full-scale physician market research study, it’s essential to determine the right approach.

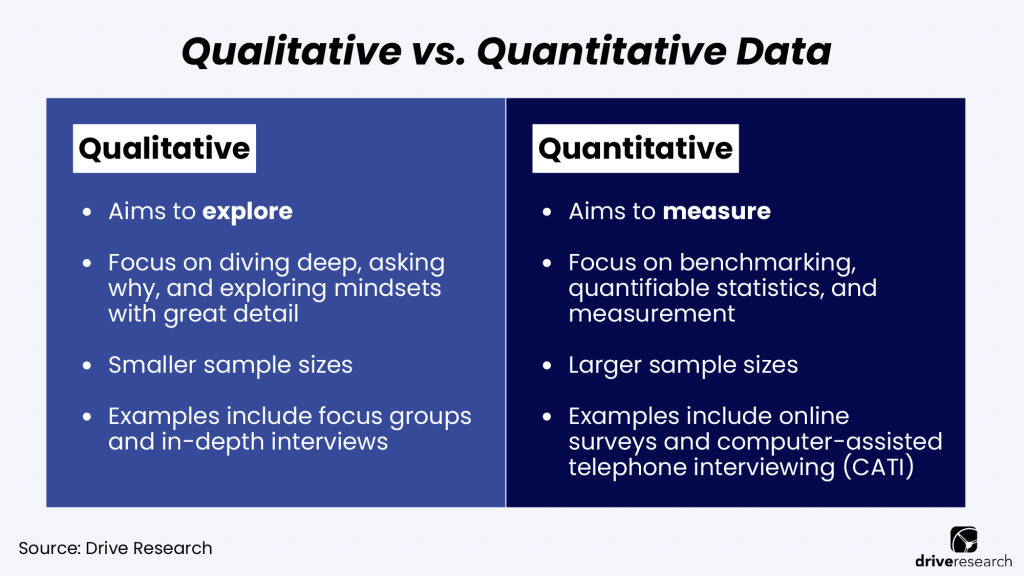

There are 2 paths to explore in terms of healthcare market research. This includes:

- Qualitative market research

- Quantitative market research

Qualitative and quantitative research each play a crucial role in gathering insights from doctors. While qualitative research focuses on exploratory conversations to uncover key themes, quantitative research validates those findings with broader data. Below, we break down the benefits of each method and how they work together to deliver meaningful results.

1. Qualitative market research

Qualitative market research is typically the first step prior to quantitative. It consists of research methodologies such as focus groups and in-depth interviews. It could be as simple as 5 to 10 interviews with doctors to test out your survey.

The qualitative approach is quite common when conducting physician research. Since the design of these studies is often product or service-oriented, having those in-depth exploratory conversations is a great starting point.

For companies that are developing offerings for those physicians, product exploration is key.

It goes back to making sure you start off on the right foot, ensuring your product is a good fit. The process is not always jumping right into testing a concept. Sometimes, researchers are just trying to tease out ideas like common concerns and patient experience.

Further on, concept validation often plays a role. This covers presenting a concept and receiving feedback.

In most instances, Drive Research recommends conducting a qualitative study first for several reasons such as:

- Qualitative provides perspective and opportunities to ask why.

- Qualitative offers the option to be fully exhaustive with lists prior to a survey.

- Qualitative uncovers findings and opportunities to dig deeper into follow-up phases.

- Qualitative offers time to digest, reexamine, and refocus the research.

To learn more about why our healthcare market research firm recommends this strategy, read our blog post: 4 golden rules as to why qualitative research is conducted before quantitative research.

2. Quantitative market research

Once sufficient research has been done early on in the process, that’s where the quantitative aspect comes in. Where qualitative is exploratory, quantitative is all about measuring. At this point, you’ll need validation from a broader audience.

Quantitative market research provides key data points across a wide sample pool. Where qualitative market research could be as simple as 5 to 10 interviews with doctors, a quantitative study could be a follow-up survey with 400 healthcare professionals.

It helps provide more objectivity and accuracy to your qualitative results. Plus, you can collect information quickly as most studies can be completed in one week.

Again, these are questions like:

- Are the pain points similar?

- Is the concept useful?

- What are the main concerns?

It’s important to note that sometimes you can use a hybrid approach and combine both qualitative and quantitative research in a physician survey project.

For instance, researchers may conduct in-depth interviews (IDIs) at this point in the process. This research method gathers detailed information to create high-quality feedback. It’s not uncommon for at least a couple of interviews with doctors to use a similar script.

Steps to Conducting Market Research With Healthcare Professionals

Before we get into the tips to assist with your market research, let’s spend a little time discussing the process.

The process to conduct market research should follow a structured path.

No experience with market research? That’s okay.

Here is what the step-by-step approach looks like.

- Proposal: this is a formal request to a market research company to propose a scope.

- Kickoff: once you decide on a partner, hold a kickoff meeting to finalize objectives.

- Workplan: this outlines the approach with timelines, responsible parties, and tasks.

- Instrument design: this is the structuring of the guide or the survey.

- Testing: it always makes sense to test the instrument internally or with live respondents.

- Fieldwork: once tested, you are ready to begin full fieldwork for the interviews or surveys.

- Analysis: this begins once responses begin rolling in and after data collection is complete.

- Reporting: this includes a summary of themes and a question-by-question breakdown.

- Debrief: your healthcare market research partner meets with your team to discuss findings.

- Action items: these are the recommendations and strategies suggested based on the data.

Tips for Conducting Market Research With Doctors and Physicians

Conducting market research with doctors and physicians requires careful planning and a strategic approach. Given their demanding schedules, gaining their participation can be challenging. However, the right methodology, incentives, and timing can make a significant difference. Below, we share key tips to help ensure your research is successful, from selecting the best approach to engaging physicians effectively.

Tip #1: Keep the study as short as possible

We all know one thing: doctors are very busy. Their number one goal in their profession is to help patients. Unfortunately, their goals do not revolve around taking surveys and participating in interviews.

Knowing this, it is critical to keep your engagement as short as possible.

Because of this, doctors and physicians often incur higher refusal rates than other business or consumer audiences. Depending on the time of the year, the refusal to assist with market research could be higher than others.

Avoid the end of the year.

For some professions, doctors end up being really busy towards the end of the year (November and December) because patients are using up their final dollars as part of their healthcare plan before the deductible resets in January.

If patients use up their deductible, they are more apt to go see a doctor or physician at the end of the year and book an appointment. This causes a lot of appointment setting and requests at the end of the year.

This makes it difficult for a doctor to pull away to complete an interview, phone survey, or online survey.

Only cover the core criteria.

All in all, it is important to keep the market research as short as possible.

Surveys need to be direct and cover the core criteria. If possible, aim for 5 minutes or less. If you end up asking for a 15 minute or 30-minute survey you’ll likely have to pay a lot in rewards to receive responses.

Similarly, with a phone interview, keep the engagement to 10 minutes to 15 minutes.

Again, extending this beyond 30 minutes or closer to an hour will not only hurt you from a lower participation rate but also require much higher rewards.

Keep the doctor’s perspective in mind.

Some of you are likely thinking, “I have a lot of objectives and goals. There is no way I can get all of my answers in a 10-minute phone interview.”

If you are in this boat, you need to keep the doctor’s perspective in mind.

$100 for a 60-minute phone interview? No thanks.

Are they more apt to participate in a 10-minute phone interview or 60-minute phone interview?

Are they more apt to participate in a 5-minute survey or 30-minute survey?

If you need a lot of feedback, think about the following 2 options:

- Chunk down your questions to cover only the core criteria, trim the fat.

- Think about splitting the research into 2 or 3 waves, each shorter in duration.

Recap of Tip #1:

Keep it simple, doctors are very busy.

High refusal rates with doctors.

Try to shy away from end-of-the-year research.

Surveys need to be short (10 minutes, 5 minutes, or less).

Phone interviews need to be short (15 minutes, 10 minutes, or less).

Not long enough? Prioritize your objectives or split the research into several waves.

Tip #2: Work with the doctors’ schedules

We all know that doctors are busy and have little time to spare.

It’s key to target physicians that actually have time to be part of medical market research. Setting those expectations in advance clears up any potential miscommunication in the future.

Be clear about what you need out of the research.

As research moderators, it’s important to understand that a doctor’s schedule may be the opposite of yours–and that you may need to plan accordingly for this.

In other words, workaround the doctors’ schedules, do not force them to work around you.

This is an important one and one that a lot of market research firms simply do not get and it grinds our gears. The lack of flexibility from other market research firms is not only true in healthcare research but other industries as well.

When you are trying to schedule a 15-minute interview with a physician please do not offer them a small window to participate.

There are a lot of moderators and interviewers out there who only want to work from 9:00 a.m. to 5:00 p.m. and they are completely unwilling to bend beyond those times.

Unfortunately, these time slots often don’t work for doctors.

You must be willing to be flexible and offer after-hour time slots even if this is an inconvenience for you.

We often schedule a lot of our phone interviews after-hours. If these times are more convenient than daytime business hours for participants we’ll oblige even if it is as late as 9:00 or 10:00 p.m.

Heck, I’ve even completed interviews for a global manufacturing firm with participants in India at 3:00 a.m. Whatever it takes.

This cannot be hammered home enough for healthcare. It is important for you as the market research team to accommodate the availability of the doctor not for the doctor to accommodate the availability of the market researcher.

Luckily, doctors that are recruited for these studies are familiar with conducting physician research.

They’re often already part of a research panel, so the structure of this kind of study is not a surprise. At this point, they know that they’re involved to provide an expert opinion.

Recap of Tip #2:

Work with the doctors’ schedules, not your schedule.

This will likely require interviews booked before hours (7:00 a.m.) or after-hours (8:00 p.m.)

Accommodate the doctor as much as possible (calling back at another time, etc.)

Tip #3: Prep the Audience

As with any type of market research, you want to get your physicians’ input before you start putting a lot of money and time into a new product or service. Since this new item is going to be targeted at a medical audience, getting a doctor’s input is essential.

You want to validate your concept by talking to physicians, but it’s also important to make sure you’re on the right track with product/service features and an overall offer.

Being able to address potential issues and concerns a medical audience may have ahead of time will save you time and stress.

Recap of Tip #3:

Make sure you know what the doctors want.

What’s more, is this product or service something they’ll actually use?

Tip #4: Create a Screener

For the recruitment process, a screener is developed to ensure the target audience is reached.

If you’re looking for physicians in certain types of specialties, those can be targeted in this process. For example, if you were looking for gastroenterologists or cardiac surgeons, those categories could be zeroed in on.

Another important factor in the early stages of conducting physician research is really analyzing the product or service in question. There may be additional qualifiers that are considered to be the right target audience.

By 2025, the surgical robot industry is expected to expand by 24%, according to a recent study–we’ll use this as an example.

Say researchers wanted to test out a new surgical robot with doctors. They should make sure their audience is physicians that are in the stage of their career to use that platform.

For instance, doctors who do not practice surgery, or who are brand new to surgery, would not be a good target audience in this example.

Whether the new product or service is to help doctors manage their workload, practice, or patient list, it’s essential to make sure they would actually use it.

Recap of Tip #4:

Screeners in market research ensure that the right audience group is targeted.

After all, you don’t want to be sending out questions to a group of doctors that have no use for a product.

Screeners prevent this from occurring.

Tip #5: Offer large rewards

If you want to survey physicians or doctors, you’ll have to pay. You cannot expect to conduct a survey, interviews, or focus groups with this audience and not expect to pay significant rewards.

Fact is a fact, doctors run a business just like everyone else.

If they are asked to participate in a market research study, many will do the simple math. “If I get paid $500 per hour to deal with patients, why would I step away for 1-hour to do an interview with a healthcare market research company for $100?”

If you are planning to conduct market research with this audience, expect to pay.

Phone interviews typically range in rewards from $200 to $250+. Survey rewards are often built into the cost per complete with your healthcare panel vendor.

The cost per completed response for surveys can range upwards of $40, $50, or more. This adds up if you are looking to obtain 400 survey responses.

Recap of Tip #5:

Remember: Doctors run a business just like everyone else.

Doctors will run the simple math: revenue from a patient for 1-hour vs. the research.

Expect to pay $200 to $250 at a minimum for a phone interview.

Expect to pay $40+ per survey complete with doctors. This includes rewards.

Recommended Reading: Higher Rewards Can Equal Lower Market Research Costs – Here’s Why.

Tip #6: Conduct the research individually, not in groups

The fourth tip for conducting market research with doctors points to the methodology. Because doctors are very busy it is difficult if not impossible to find a window of time where multiple doctors would be available.

Think about in-person focus groups. If a doctor is available at 2:00 p.m. for a focus group, chances are the 7 other participants will not be.

If 2 doctors are available at 7:00 p.m. for a focus group, chances are the other 5 are not. Coordinating multiple doctors to show-up for a specific time slot is very difficult.

Consider online qualitative methodologies.

This becomes a little easier with online focus group research than in-person.

With online focus groups, the doctors would not have to leave their office or their laptops to participate. The doctor is required to sign-in several times during the day and review comments, post new questions, and post answers.

This makes the focus group approach slightly more feasible than in-person focus groups.

Fear of competition among local doctors.

The other reason to be concerned with group participation is doctors are often unwilling to share feedback with other physicians who they may consider to be competition.

Putting together a group discussion with dentists in a specific market area to talk about marketing strategies, obtaining new patients, and improving the patient experience would become impossible.

The discussion would not be productive because doctors would fear sharing information that could be used against them.

Therefore one-on-one and individualized settings for market research are preferred when working with doctors and physicians.

This allows the moderator to separate feedback individually and promise anonymity and confidentiality with the responses.

Something that is not so easy when the room is filled with 11 competitors.

Recap of Tip #6:

Steer away from group settings with physicians.

Difficult to find one common time for all, some do not want to talk with the competition.

Online focus groups or bulletin boards can be a better fit.

Suggest doing 1-on-1 market research to offer anonymity and confidentiality.

Individual interviews also offer more flexibility for scheduling.

Tip 7: Use a vetted email list or vendor to recruit

Consider using a market research panel. Our market research company partners with several healthcare panel companies to administer surveys and manage physician qualitative recruitment.

Our firm receives contracted reduced rates from these panel companies because of the volume of work we complete with the list vendors.

Cold calling a doctor or physician to participate in market research will likely yield poor results.

Very frankly, there are a lot of doctors who simply will not and have never participated in market research. This won’t change from one phone call no matter how good your qualitative recruiter is.

Dialing offices to schedule doctor interviews or booking them for focus groups incurs a very low qualification rate.

Even if the doctor may be interested, chances are your call will never make it past the gatekeeper.

Calling physician offices offers a very low return. There is a slim chance you will get through the gatekeeper and actually have any time with the physician to generate interest in the market research.

These administrative employees field phone calls for doctors and is skilled at deflecting sales vendors and research recruiters alike.

Remember, they likely receive several of these sales calls per day and the chance of any one of them making it to the doctor are slim to none.

The best-case scenario you can hope for during a phone call is the administrative assistance requesting more information to pass to the doctor. In this scenario, you either fax or email a one-pager to the office in hopes the person will forward it along to the doctor or put it on his or her desk.

Again, the likelihood of this occurring is minimal.

The front office often uses the “send me something” approach as a simple way of getting off the phone with the recruiter.

Benefits of using a panel vendor.

Healthcare panel vendors are essentially email list companies who offer a vetted list of doctors and physicians who are willing to participate in market research.

These doctors have raised their hands and said, “If you need to collect feedback, I am willing to offer my thoughts and opinion”.

This panel vendor route is likely the only feasible and cost-effective route to go when conducting market research with doctors.

Although still costly, it is far less expensive than hiring a call center to cold call doctor offices. It will also take much less time to recruit than a typical call center project which could last months.

When is a panel vendor not an option?

If the study is small and regional in-nature and no healthcare panel exists, you may want to explore visiting the offices in-person.

This can often increase the chances of face time with the physician over a generic phone call.

Try to either schedule these prior or stop in-person and bring some giveaways. A simple tactic here is to do a lunch and learn or drop off lunch. This may give you a few minutes to chat with the physician or doctor staff to generate interest.

When you think about the time and cost involved with in-person visits like this, it adds up quickly. We would not recommend this for a project with a lot of interviews or a survey.

If you are simply looking to conduct 4 or 5 interviews with local cardiologists or dentists in a region, this may be feasible.

Recap of Tip #7:

Go the healthcare panel vendor route if feasible.

Panel vendors offer options for recruitment and survey feedback.

Conducting cold calls to offices to recruit is not recommended.

If the scope is small enough, consider in-person visits or lunch and learns.

In Summary

Conducting market research with doctors and physicians is no easy task. Among the B2B audiences you try to reach, this healthcare audience is among the most strapped for time.

Therefore it is critically important to approach this audience correctly. Trying to launch a study without using these tips will likely result in failure.

There are several tips our team has learned over the years when dealing with doctors and physicians. These tips are a culmination of surveys and interviews we have conducted.

Here are the best tips to keep in mind:

- Keep it as short as possible.

- Workaround the doctors’ schedules, do not force them to work around you.

- Offer large rewards.

- Conduct the research individually, not in groups.

- Use a vetted email list or vendor to recruit.

When it comes to a challenging audience, you will likely not get a second chance to collect feedback.

Contact Our Healthcare Market Research Company

Just as there are many specialties in medicine, there are many ways to go about conducting market research with doctors and physicians. Going into medical market research without knowing the target audience, how to recruit, or a project outline will create unnecessary difficulties.

Having clear objectives and specific information on what to talk about with physicians will make this fascinating field of research a whole lot easier.

Drive Research is a national market research company in Upstate New York. Our team conducts doctor and physician market research with various healthcare organizations across the country.

These tips were derived from a recent global interview and survey project conducted with cardiologists and emergency department (ED) physicians. This healthcare market research project was conducted across the United States and in Spain, Germany, Italy, France, and the United Kingdom.

To receive a quote for a market research project with Drive Research, contact our team below.