Jewelry is one of the most fascinating consumer products when it comes to purchase motivations.

There are a wide range of reasons for buying jewelry including social status, sentimental value, gift-giving, commemorating special occasions, expressing oneself, and many more.

Therefore, conveying the right marketing messaging to all these different consumers is not an easy feat. This blog post explores how our market research company surveys jewelry buyers including a real-world example of a recent project we completed with a global jewelry brand.

Why Survey Jewelry Buyers?

Surveying jewelry buyers is crucial for understanding market trends, preferences, and consumer behavior in the jewelry industry.

It provides valuable insights into popular styles, materials, and price points, aiding manufacturers and retailers in product development and pricing strategies.

Additionally, customer feedback from surveys helps build stronger relationships with buyers, enhancing customer satisfaction and loyalty in a competitive market.

Steps to Conducting a Jewelry Shopper Survey

Understanding the intricacies of your jewelry market is paramount for any business looking to thrive in the industry.

One effective way to gain valuable insights is by conducting a well-structured survey among jewelry shoppers.

In this section, we will explore the essential steps to successfully execute a jewelry shopper survey, offering the proven strategy our online survey company follows for harnessing customer preferences and trends.

Steps to collecting feedback from jewelry wearers with surveys include:

- Define Clear Objectives: Clearly outline what you aim to achieve with the survey, whether it’s understanding buying motivations, evaluating product preferences, or assessing customer satisfaction.

- Identify Your Target Audience: Pinpoint the demographic and psychographic characteristics of your ideal survey participants. This ensures that your findings are relevant and applicable to your specific market segment.

- Choose the Right Survey Method: Select the most suitable method for your target audience, whether it’s an online survey, in-person interviews, or a combination of both. Consider accessibility and convenience for participants.

- Craft Thoughtful Survey Questions: Develop questions that align with your objectives, ensuring they are clear, concise, and unbiased. Use a mix of closed-ended and open-ended questions to gather quantitative and qualitative data.

- Implement the Survey: Deploy your survey using the chosen method. Provide clear instructions and maintain a user-friendly format to encourage maximum participation.

- Analyze Responses: Thoroughly analyze the collected data, identifying patterns, trends, and key takeaways. Utilize statistical tools or software to derive meaningful insights.

Case Study: Jewelry Buyer Survey

A national jewelry and lifestyle brand sought to understand its growth opportunities within the jewelry category in the U.S.

The client identified the need to segment jewelry consumers and worked with Drive Research to address their research objectives.

The three primary objectives of the research were:

- Completing a jewelry category segmentation with attitudinal depth, demographic, and behavioral insights that the current client customer base could be typed to

- Analyzing how the client customer base fits into the jewelry category segments

- Understanding what makes each segment tick, which segments are growing, and where the client fits in

To illustrate the steps we covered in the previous section in action, we’ll dive deeper into how our meticulously conducted survey helped the jewelry brand make future business decisions.

The Solution

To tackle the client’s objectives, a three-phased research plan was recommended:

- Phase 1: Jewelry Category Segmentation Online Survey

- Phase 2: Client Customer Segmentation Online Survey

- Phase 3: Priority Jewelry Segment In-Depth Interviews

The idea behind these methodologies was to identify category jewelry consumer segments in Phase 1, apply the category jewelry segments to the client’s customers in Phase 2, and deep dive into key jewelry segments that present the most opportunity for the client in Phase 3.

Online surveys offered a practical way to reach both U.S. jewelry consumers and client customers for the first two phases.

Whereas in-depth interviews in Phase 3 allowed the client to obtain a richer understanding of who the key segments were and how their brand could best appeal to them.

The Approach

The research process began with a thorough kickoff meeting with the client to discuss objectives and expectations for the project.

For Phase 1, a survey questionnaire was drafted that asked questions about jewelry purchasing behaviors, psychographics, and demographics.

The data collected in this survey was ultimately used as input for the advanced analytical approach of market segmentation.

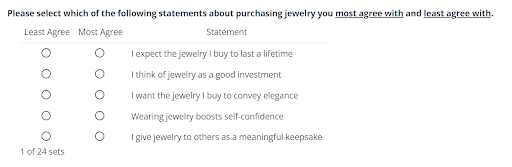

This centered on a MaxDiff question series that asked respondents to select which statements about jewelry they most agreed with and least agreed with from a randomized list of five statements.

Once approved by the client, the survey was programmed and tested comprehensively. The survey was fielded using a market research panel platform of over 44 million respondents to reach a census-balanced audience.

The survey data was cleaned for quality and subsequently used for market segmentation.

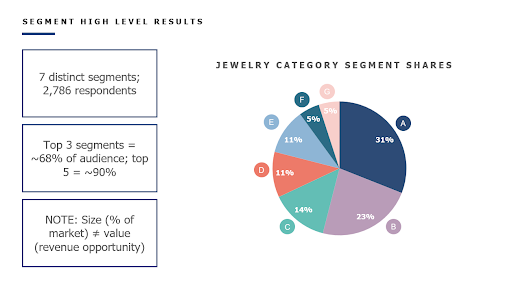

This process leveraged advanced statistical techniques including structural equation modeling and hierarchical cluster analysis to create seven distinct jewelry consumer segments.

Detailed profiles of each segment and a typing tool were delivered to the client at the end of Phase 1.

Curious about doing your own segmentation study? Here are six essential steps to conducting a customer segmentation.

A typing tool is an algorithm-based calculator that inputs respondent data and assigns the most likely segment.

This allows you to determine the segment in any future research as long as you capture the relevant data.

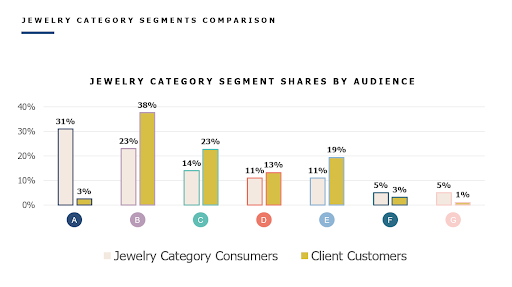

In Phase 2, a near-identical survey about jewelry purchasing was distributed among the client’s customer base.

The typing tool was critical in identifying the highest probability segment for each customer who responded to the survey.

This new data allowed the client to see in which category segments they over-indexed or under-indexed with their customers relative to the total market.

An updated report was shared at the end of Phase 2 that included a summary of the segmentation overlap between the U.S. jewelry market and client customer base.

Three of the seven segments were highlighted as potential growth opportunities for the client worth further exploration in Phase 3.

In Phase 3, in-depth interviews were conducted to delve into the opinions and experiences of jewelry category buyers and core customer groups.

These interviews added additional layers of understanding and nuance for how to capitalize on key segments.

The Results

The final results remain confidential with the jewelry and lifestyle brand client.

In the end, the insights gathered from the research aided the client in the development of its marketing and communication strategy.

The surveys and in-depth interviews provided direction for how to help reach new customers in 2024.

Below are the sample sizes for each phase of the research.

- Phase 1

- 2,786 U.S. jewelry consumers completed the online survey in Phase 1

- This sample size offers a margin of error of 1.9%. The margin of error is a statistic that allows you to quickly assess the reliability of a dataset. The higher the sample size (and closer to the actual population), the lower the margin of error.

- Phase 2

- 1,036 client customers completed the online survey in Phase 2

- This sample size offers a margin of error of 3.0%.

- Phase 3

- 24 in-depth interviews recruited in Phase 3 (8 per priority segment)

- Participants were over-recruited to account for potential no-shows and late cancellations

Contact Our Market Research Company

Drive Research is a global market research company.

Our team of seasoned research professionals has the expertise and know-how to conduct various qualitative and quantitative methodologies to accomplish your business, sales, and marketing goals.

Interested in learning more about our market research services? Reach out today.