Organizations often depend on market research for new product development to stay competitive within an industry.

While the process can be challenging, and oftentimes lengthy, new products and services allow organizations to grow and further improve their market share.

However, on average, 33% of new products fail and never make it to the shelves. Therefore, investing in new product research becomes imperative.

It ensures the time, cost, and resources put into launching a new product concept are worth it.

In this article, we’ll discuss more product development research including how, when, and why to do it.

Article Contents 📝

- Why conduct research and product development

- Factors to consider before product development research

- Types of product research methods

- When to conduct marketing research for a new product

- Example of market research for new product development

Interested in conducting market research for new product development? Get a quote from Drive Research by completing an online form or emailing [email protected].

Why Conduct Research and Product Development

Market research in the new product development process is essential in the creation of any item. Why?

It allows owners to understand the pros and cons of their product, giving them areas of improvement to focus on.

Therefore, conducting market research throughout the product development process, including before, during, and after is critical to the success of a new concept.

The main benefits of market research for new product development include:

- Prioritizes customer preferences, wants, and needs

- Areas of improvement to focus on

- Gauges market demand

- Assists in pricing strategies

- Creates data-driven marketing campaigns

- Ensures that the final product meets buyer demand

- Offers incredible ROI

Factors to Consider Before Product Development Research

There are a few factors to consider before hitting the ground running. Our new product development research firm outlines these in this section.

We also share three tips for conducting market research for new products in the video below.

Step 1: Set your objectives

This first step of doing new product development market research is key. You'll want to fully discuss and understand several items before you start.

Think about what you want to learn from the research.

What are your expectations?

What actions will you be taking?

Also, consider who you want to target for product testing.

While most market research is typically focused on target customers, it’s important to note that other stakeholders need to be involved in research product development.

This includes:

- Sales representatives

- Leadership teams

- Customer support teams

- Distributors

- Engineers

- Marketing

These audiences should be included in the research through any of the methodologies we discuss today, or at a minimum be represented in some other way during the product design meetings.

Step 2: Determine your scope

The scope is determined by several factors and many of these overlaps with objectives.

Answer questions like...

- Who do you want to target?

- How long will the test run?

- What are the steps and instructions involved in the test?

When it comes to product testing you will want to be as specific as possible, especially if you are sending your shipment to participants to test products at home.

For example, let's say your company is sending a dish detergent to a client and you need them to download an app to log a diary of usage and feedback around the project for the course of 1-month.

The scope may need to include instructions during shipping such as:

- Information to download the app

- Instructions to register a free account

- Instructions to open and record feedback in the diary

- How often to test the product

- Who to call or email with questions

It’s often best to share your project budget with your market research company.

With this insight, the market research team can craft the best approach and methodology for your product development research based on the funds you have available.

Step 3: Find a full-service market research partner

The most challenging and time-consuming piece of new product development research (both qualitative and quantitative) is recruiting.

This is recruiting in terms of finding participants for testing or finding survey respondents for a larger study.

Therefore, it’s best to work with a full-service market research company that specializes in both qualitative recruiting and methodologies like focus groups and online surveys.

Other factors you will want to look for in a market research vendor include:

- Being responsive. Product testing recruitment can be a long process, find a vendor who is responsive and willing to provide regular updates on progress.

- Find a market research company that is flexible. One that is willing to work and do more to make sure your project is successful.

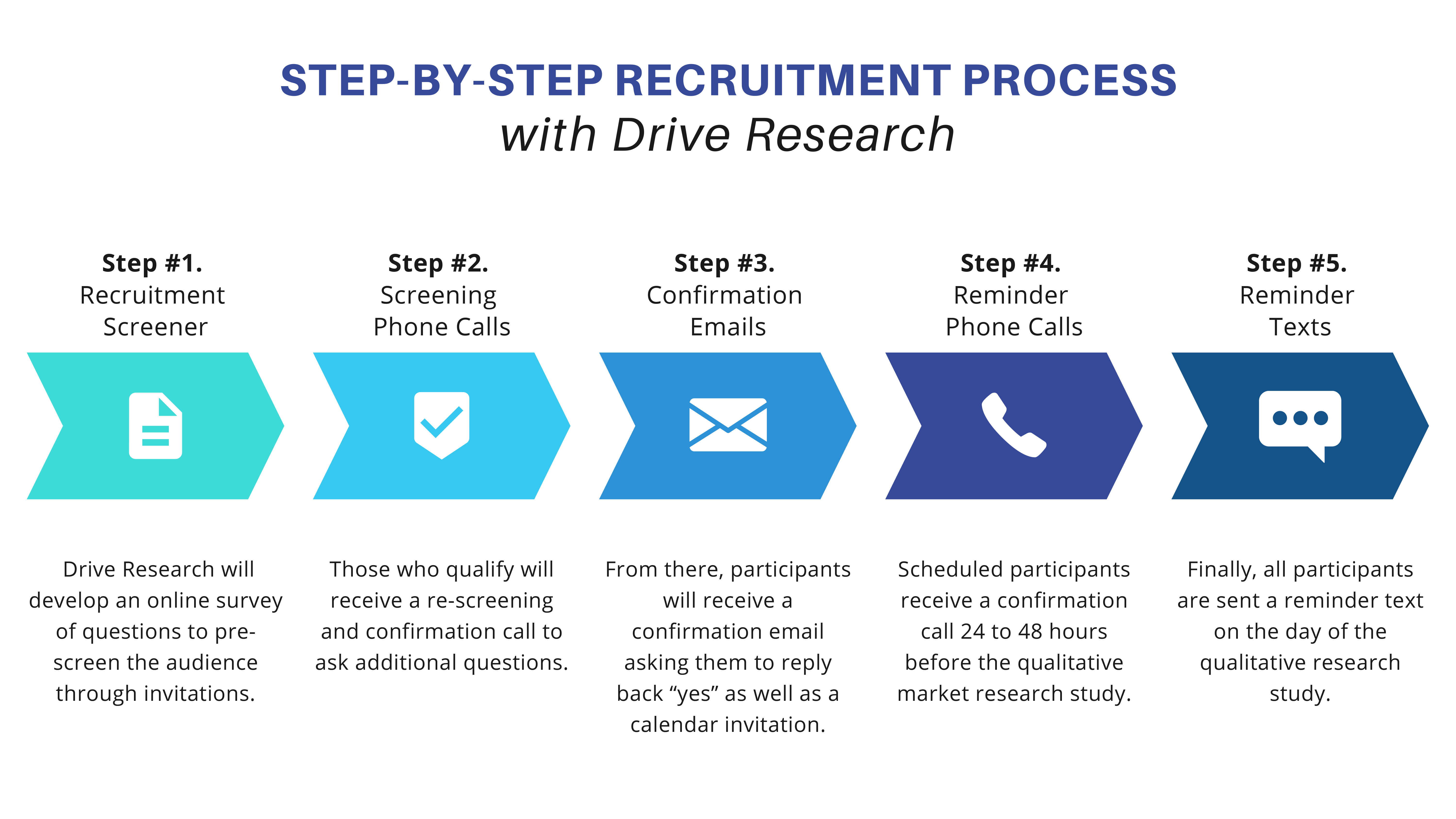

- Adds rigor to the confirmation process. Simply signing up participants through an online survey is not enough. Make sure the vendor adds confirmation emails, phone calls, or even texts.

For instance, here is the qualitative recruiting process our market research company follows for new product development studies.

Obviously, other items such as cost, expertise, industry experience, and others come into play as well.

Ultimately, the choice is up to your company and what you deem is most important.

Though, we encourage you to add Drive Research to your list of candidates 🙂.

Types of Product Research Methods

There are several different types of market research for new product development.

The choice of research methodology chosen for each phase depends on factors such as:

- Project objectives

- Product or service type

- Audience demographics

- Timeline and scope

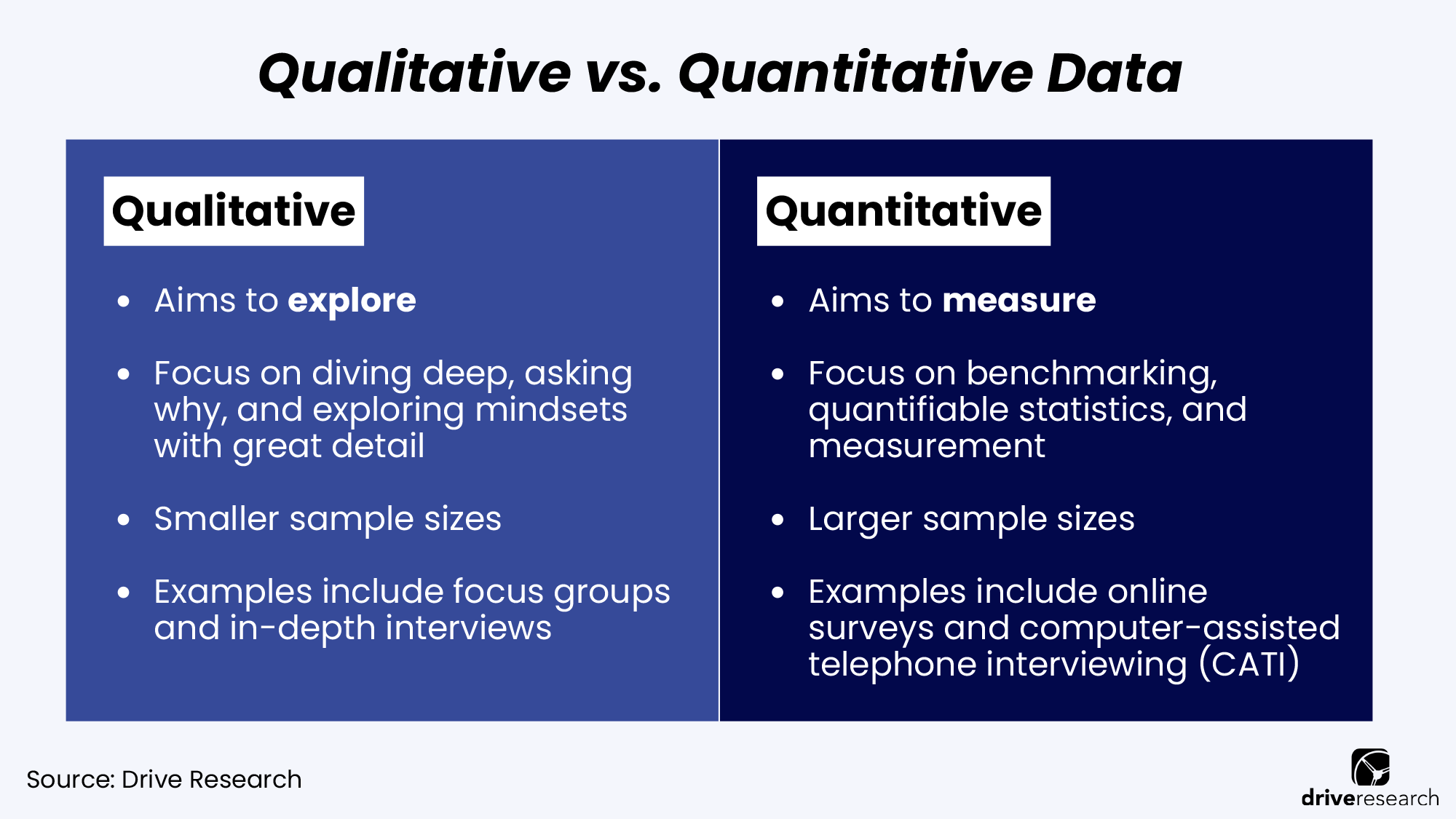

With that said, new product research typically includes both quantitative research (which provides statistically reliable findings), and qualitative research (which provides detailed feedback).

Quantitative Research Options for New Product Development

Our market research company often recommends an online survey as a form of data collection for companies looking to measure the appeal of a new product concept.

Easily conducted on a mobile device, online surveys are typically sent via email to the participants.

This common form of quantitative market research aims to gather the “big picture” of a project.

Benefits of online surveys for new product research include:

- They are ultra-accessible. Online surveys are typically sent via email or target Facebooks ads, making them easy to fill out on mobile, desktop, and tablet devices.

- Fast feedback. Online surveys can quickly deliver results from your target consumer, regardless if they are B2B or B2C.

- Low cost. This approach is much more cost-effective when compared to other quantitative methods such as a phone or mail survey.

There are additional benefits if you choose to work with a third-party research company for new product demand surveys.

Their experts will write unique survey questions based on your main objectives to assure you receive high-quality feedback to make data-driven decisions.

Additionally, the research agency will program the survey, clean the data, and offer recommendations for how to use the insights when creating your new product.

Qualitative Research Options for New Product Development

While there are various studies available for product developers, Drive Research often recommends focus groups as our top choice.

Compared to individual interviews or IDIs, focus groups are particularly valuable when trying to explore consensus on a given product, service, or topic.

They are especially useful for helping your team generate hypotheses, develop questions, and understand concepts.

If choosing to conduct focus groups for product development research, look for a company that also specializes in qualitative recruiting services.

This will assure those participating in your group discussion are highly targeted and qualified.

In particular, there are five key benefits to focus groups that should not be underestimated for new product development.

1. Explore more than quantitative data

Focus groups are exploratory in nature. They provide a highly flexible and alternative way to obtain consumer information without using a survey.

Focus groups offer the distinct advantage of helping your team gain valuable, actionable insight into your product or services.

For example, let's say you conducted a survey and found that 75% of your target customers rely on reviews when purchasing a new product.

By using a focus group, you can explore more into the "what" and the "why?"

- What review sites do customers look to for products similar to yours?

- What is considered a positive rating? 3 stars and above, or higher?

- Why are online reviews so important?

The goal of a focus group is not to necessarily reach some level of agreement or decide what to do.

Instead, the idea should be to identify feelings, perceptions, and thoughts about a particular topic.

Then, your team is able to use this in-depth qualitative feedback to make adjustments to product development, marketing initiatives, or general business strategies.

2. Collect different opinions all at once

Surveys can be somewhat cumbersome. You typically send out your questionnaire to hundreds, if not thousands, of individuals and then wait weeks to get enough responses back.

This process may be shorter or longer depending on who your target audience is and how many responses you would like to collect.

On the other hand, a focus group generally consists of 4 to 12 people who are most similar to your target buyer for the new product or service.

These participants join a 60 to 90-minute group discussion as a moderator leads the conversation and touches on everything you need to know instantly.

We discuss this more in, What is the Best Length for a Focus Group?

3. Create an interactive environment

In-person interaction is always highly valuable.

There’s a reason why companies prefer in-person interviews compared to video interviews—you just can’t get the same feedback online.

The same goes for focus groups compared vs. survey research, especially when it comes to evaluating your product concept.

Focus groups allow people to physically see, touch, smell, and use your product. In this way, you get their full feedback or reaction to your product.

It’s immensely helpful when it comes to enhancing or changing your product based on actual user experience.

Although, online focus groups are growing in popularity. This methodology may serve as a good middle ground for conducting focus groups for new product development, but more cost-effectively.

Considering an online focus group? In this post, we compare the advantages and disadvantages of traditional vs. online focus groups.

4. Support new business decisions with facts and evidence

As explained above, the value of a focus group is to gain feedback on your product or service immediately in an interactive environment.

What this means is that you can solve mistakes before your product or service launch.

The entire point of market research for new product development is to reduce serious gaps between what your internal team thinks and what your customers think and feel.

And focus groups accurately capture just that.

5. Narrow down customer wants and needs

Products and services must constantly change to adapt to the changing needs and wants of customers.

And focus groups offer a great way to drill down into these ever-changing needs to identify what matters most to your target demographic.

They’re a great way to sit down with your customers and learn something new.

When to Conduct Marketing Research for a New Product

The key to market research for new product development is to make it an ongoing process.

It should not be a one-and-done study, but something that acts as a continuous performance measurement and tracking.

For instance, you don’t want to wait until the prototype phase to get feedback from your target demographic.

Instead, you should plan multiple market research studies throughout the product development process to gain immediate feedback on each phase.

If anything, our market research company recommends conducting two studies – one in the initial stages of testing a new concept, and another when you have a physical product.

Keep reading as we discuss these two phases in greater detail.

Phase One: Market Research Before Creating a Product

There are many things entrepreneurs should research before creating a product and exploratory research (such as focus groups) is a good starting point.

One of the most important steps in new product development, it provides value, even if an organization is in the initial phases of concept testing.

Questions market research can answer before creating a product include:

- Is there a market need?

- What is the awareness of products available on the market?

- Are customers satisfied with the products available?

- How could products on the market be improved?

- What new products/features is there interest in?

- What are the customer needs? What needs are not being met?

- What type of customer would be most interested in a new product?

- What does the decision-making process for buying the product look like?

Gathering answers to these questions will help business owners understand the general needs of the market and identify new product or service opportunities for your organization.

Additionally, this type of new product research gives an understanding of current customer satisfaction and provides direction for optimizing and marketing current product/service offerings.

The best research options for new product idea generation and concept testing include:

- Focus groups

- In-depth interviews

- Online surveys

- Competitive assessments

After conducting exploratory research (formally or informally), that should mean an organization has identified a need within the market. In other words, you are set to develop a new product that customers will be interested in.

Phase Two: Prototype Testing

The main goal of new product testing research is to have your target audiences evaluate the new product and ensure that the product meets their needs.

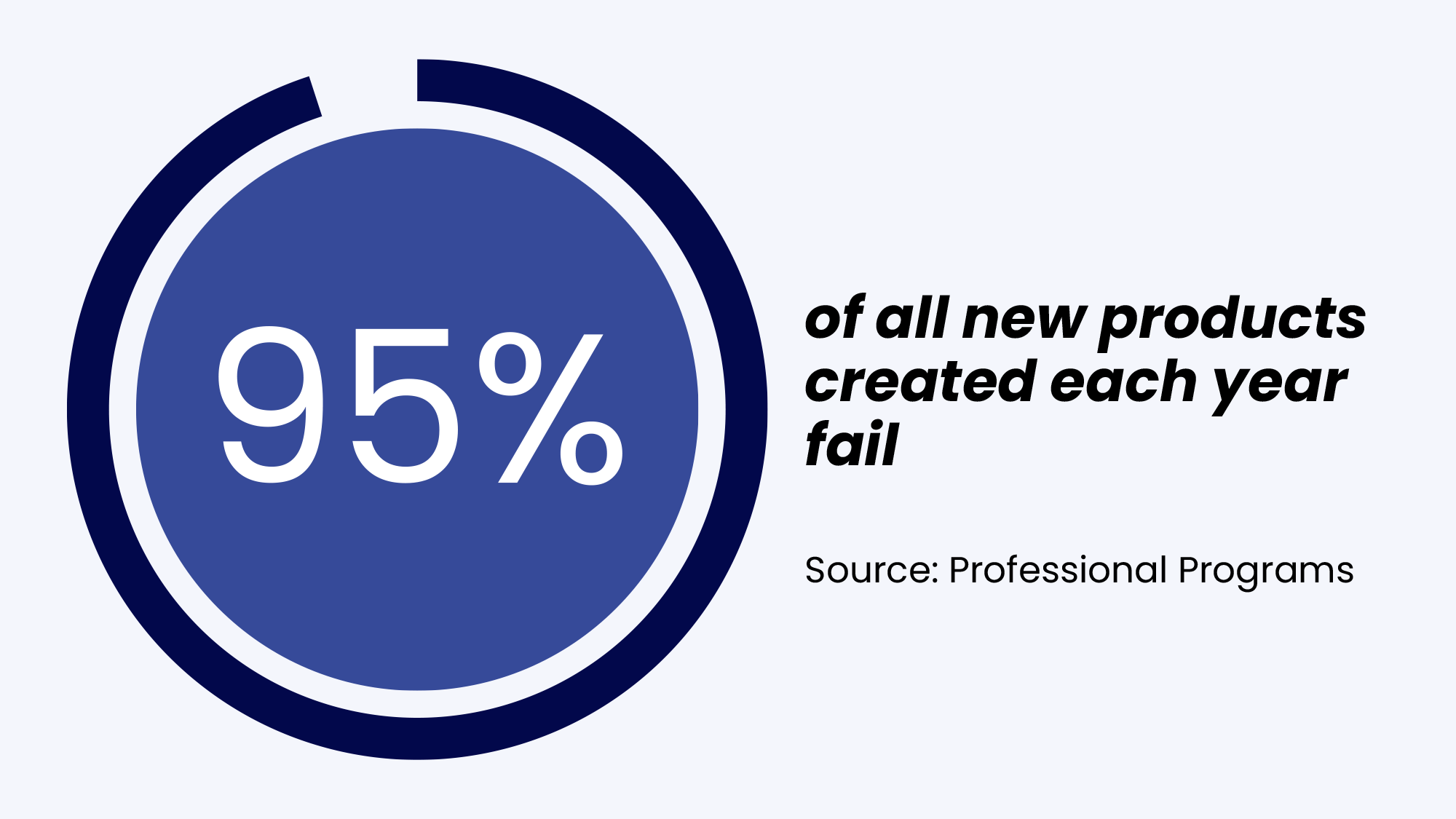

After all, nearly 30,000 new products are introduced each year, and 95% of them fail.

Many of the reasons why new products fail center around not using data and consumer insights to drive decision-making.

To avoid this, market research for new product development will provide insights into changes that must be made before a product is finalized and hits the market.

It can also help guide the product launch through marketing insights.

Questions market research can answer after a product or prototype is created include:

- What do customers like about the concept/product?

- How could the product be improved?

- What would the customer use our product for?

- What features/specifications are the most important?

- How likely would customers be to purchase the product?

- How much would customers pay for this product?

- What research options are available for prototype testing?

Depending on the complexity of your product, this type of research may need to be re-visited at multiple points throughout the product development process.

In the beginning…

Early in the process, you may have a basic concept and idea that you want to test before proceeding. Conduct new product research now!

In the middle…

In a few months, your brand may have more detailed product specifications with renderings or product mock-ups. Again, conduct market research!

In the end…

Finally, near product design finalization, you may have an actual prototype or final product that the consumer can evaluate and provide feedback on.

You guessed it – conduct prototype testing research!

The best research options for testing a prototype or existing product includes:

- Voice of the customer (VoC)

- IHUTs (In-Home Usage Testing)

- In-depth interviews

- Focus groups

- Online surveys

Recommended Reading: Ultimate Guide to In-Home Usage Tests

Example of Market Research for New Product Development

Drive Research is a market research company that specializes in new product development. This includes conducting various methodologies such as online surveys, focus groups, and in-home usage tests.

Recently, we conducted a new product development market research study on behalf of a fragrance and essential oil diffuser manufacturer.

In this section, we'll discuss the real-world objectives, processes, and outcomes to give a better example of how (and why) organizations can conduct product and development research.

For the sake of confidentiality, the client's name will remain private.

Overview of the new product development study

A fragrance and essential oil diffuser manufacturer is currently developing a nebulizer, ultrasonic diffuser, and wax warmers (tabletop and plug-in).

To start, the brand would like to gather user feedback on the new nebulizer.

The research would entail 2 rounds of research, with the first being focused on functional feedback, and the second focused on the final product, including packaging.

The market research will assist the client with new product development decisions, product expansion, marketing, and strategy.

Approach to new product development market research

The first phase of the study included functional IHUTs and email surveys.

The process included a kickoff meeting with the client, recruitment of target consumers, collecting feedback, and reporting on the results.

1. Kickoff meeting

Each market research project with Drive Research starts with a kickoff meeting. It is commonly held over Zoom. The kickoff meeting is an opportunity for clients to meet their project team and discuss their goals for the research.

From there, the Drive Research team creates a workplan and timeline to assure key deliverables are met on time.

George Kuhn, Owner and President of Drive Research

2. Recruiting target consumers for the IHUT

Next, our new product development market research company created a recruitment screener survey. Doing so assures each participant is qualified and matches the target criteria the client is looking for.

The recruitment screener included questions such as:

- When it comes to home fragrance products (such as air fresheners, candles, or essential oils), which of the following best describes your role?

- Which of the following types of home fragrance products do you commonly use?

- How often do you use the following types of home fragrance products?

Drive Research sent the screener survey into the field with trusted third-party panel vendors and sponsored Facebook ads.

Those who qualified for the study received re-screening phone calls to verify their answers. During these phone calls, our qualitative recruiting team also supplied instructions to ensure full participation.

We recruited a total of 40 participants to ensure 30-35+ completed the tasks and full test (the goal number requested by the fragrance manufacturer).

3. Collecting feedback with email surveys

Following the arrival of the new fragrance product, participants were instructed to use the product for four weeks.

After testing, participants answered a 20-30 question survey on the product.

The survey lasted approximately 7-10 minutes.

In addition to the product, participants were paid $40 as a thank-you after completion.

4. Analyzing the results

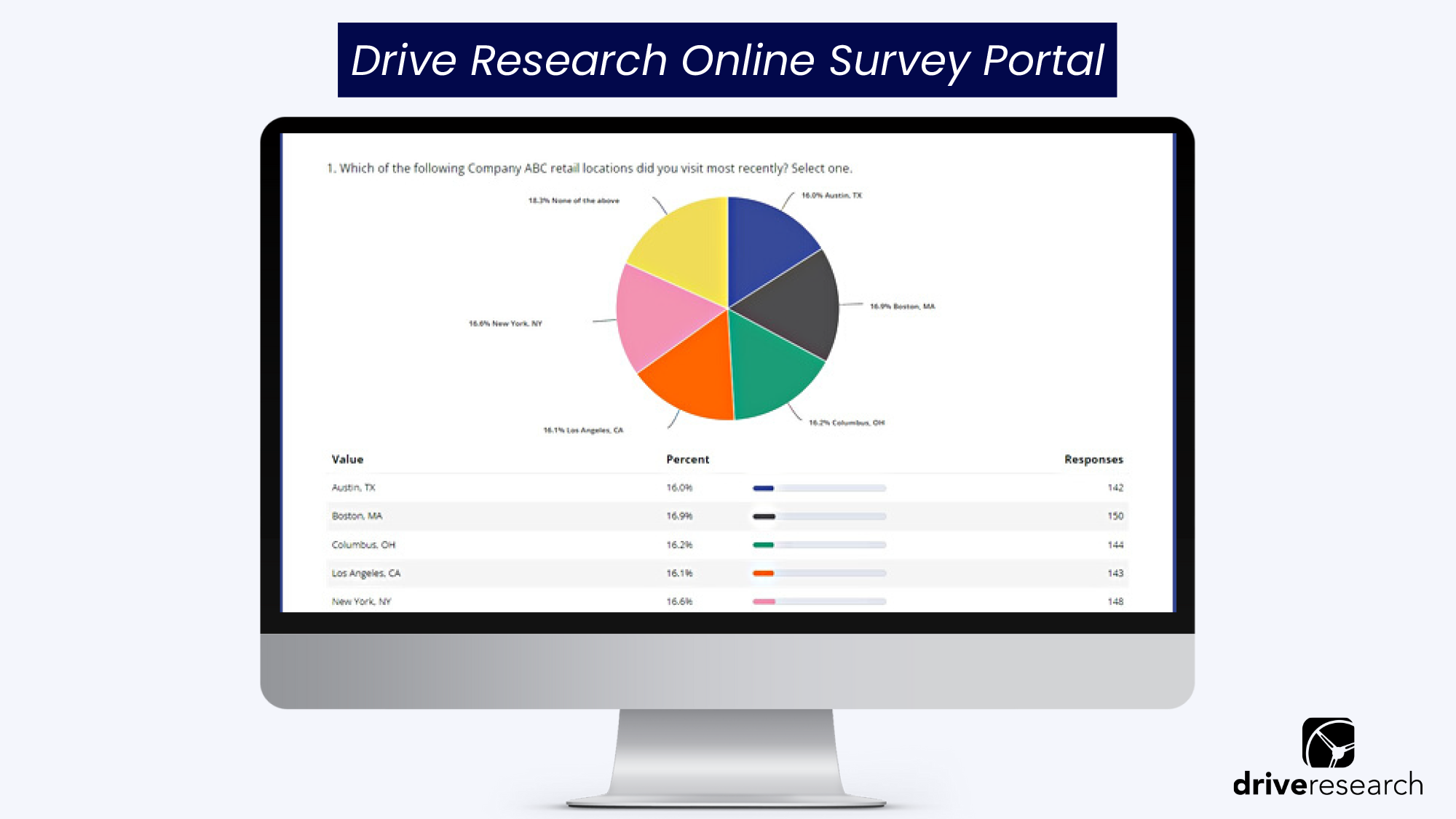

As participants completed the survey, the home fragrance manufacturer has access to a live online portal of results. This allowed the team to see responses in real-time, rather than waiting weeks for a final deliverable.

Drive Research also prepared a topline summary report document that recapped the biggest takeaways from the new product development research.

The product development research results answered key business questions such as:

- How many participants were highly satisfied with the product concept?

- How did the product concept score on factors such as set-up, ease of use, noise level, etc.?

- How satisfied were participants with components of the product such as color, effects, etc.?

- What did participants like the most about the new product? What did they like the least?

- What price point would participants expect to pay for this product?

- How likely would they be to purchase this product?

- How likely would they be to replace their current home fragrance product with this new product?

- What other suggested features would participants recommend adding to the product?

- How often did they use the product?

Additionally, our market research company hosted a debrief meeting with the client to discuss these findings with more key insights and recommendations.

Acting on the results

Based on the feedback obtained from the in-home usage test, the home fragrance manufacturer began to make functional changes to the product concept. They also made improvements to enhance the user experience.

The client addressed and fixed the following issues with the home fragrance product concept:

- Leaking with modifications to the siphon

- Lighting changes

- Noise issues

- Improved cycle time and fragrance intensity experience

- Provide a tool to help with set-up

- Added an alert to users to clean the product

Next steps for the product development

The market research for new product development didn't end with the in-home usage tests.

For the second phase of testing, the home fragrance brand will have a market-ready product complete with branded packaging.

Once the packaging is finalized, the new wave of research will follow a similar process as phase one.

The process will include a kickoff, setup, recruiting, data collection, and reporting through another round of IHUTs.

Final Thoughts

In order to ensure the time and cost invested in new product development don’t go to waste, it is essential organizations make informed decisions based on actual market opportunity and customer insights.

Market research for new product development provides project teams with these insights and guides each phase and design activity.

When a focus group company, like Drive Research, conducts this type of new product development research your team gains instant insight into your customers—their behaviors, attitudes, feelings, perceptions, and opinions—all at once.

Contact Us For Product Development Market Research

Drive Research is a new product research company that partners with organizations to deliver qualitative and quantitative insights that inform decision-making.

To learn more about our product testing services and costs, contact Drive Research by filling out the form below or emailing [email protected].

Chris Coville

As the Director of Research of Drive Research, Chris has 10 years of experience in the market research field and has completed projects with organizations across the globe. He was also named a 2017 40 Under 40 Award winner.

Learn more about Chris, here.